Managing rental property expenses can make or break your profitability. Here’s the bottom line: organizing your finances, using modern tools, and understanding tax rules can save you time, stress, and money. Poor tracking leads to missed deductions, cash flow issues, and legal risks. The good news? With the right strategies and tools, you can streamline the process, improve accuracy, and maximize your returns.

Key Takeaways:

- Track operating vs. capital expenses: Repairs are deductible immediately, while improvements must be depreciated over time.

- Use separate bank accounts: Keep personal and rental finances apart to simplify tracking and avoid legal complications.

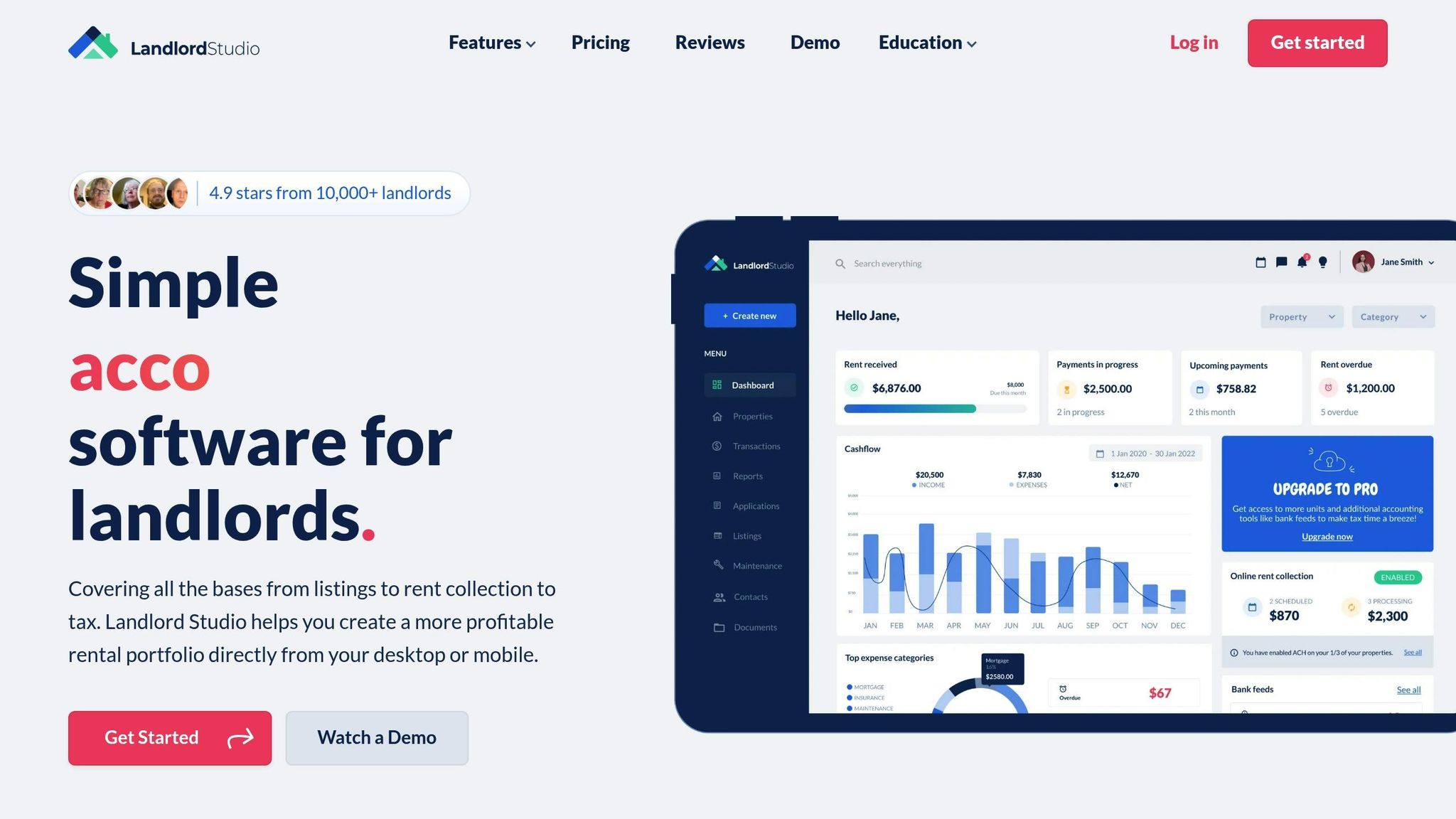

- Leverage technology: Tools like Renting Well automate expense tracking, categorize transactions, and generate tax-ready reports.

- Maximize deductions: Claim depreciation, repairs, mortgage interest, and other allowable expenses to reduce taxable income.

- Keep detailed documentation: Receipts, invoices, and mileage logs are crucial for audits and accurate tax filings.

Switching to digital tools, setting up separate accounts, and staying organized year-round are practical steps to make expense management easier and more effective.

8 Top Rental Property Bookkeeping Tips for Landlords | Landlord Studio

Main Types of Rental Property Expenses

Keeping track of rental property expenses is essential for accurate financial records, staying compliant with tax laws, and making the most of available deductions. Each type of expense comes with its own rules for tracking, reporting, and deducting.

Regular Operating Expenses

Operating expenses cover the everyday costs of managing a rental property and are fully deductible in the year they occur. These include:

- Mortgage interest, property taxes, and insurance premiums

- Repairs and maintenance to restore the property to its original condition

- Utilities paid for tenants

- Advertising costs for filling vacancies

- Property management fees

- Legal and professional services, such as tax preparation or handling evictions

- Travel expenses for property visits

- Office supplies

These expenses are essential for the ongoing operation of your property and can be deducted immediately.

Capital Expenses vs. Operating Expenses

One of the key distinctions landlords must understand is the difference between capital expenses and operating expenses.

- Capital expenses involve improvements that increase the property’s value, extend its life, or adapt it for a new purpose. These must be depreciated over time rather than deducted all at once. Examples include installing new flooring, replacing a roof, or upgrading a kitchen.

- Operating expenses, on the other hand, are costs that maintain the property in its current condition, such as fixing a leaky faucet or replacing broken windows. These are fully deductible in the year they are incurred.

| Expense Type | Capital Expense (Depreciated over 27.5 years) | Operating Expense (Fully deductible in the year incurred) |

|---|---|---|

| Examples | New roof, kitchen remodel, HVAC installation | Repairs, maintenance, utilities, insurance |

| Purpose | Enhances property or extends its life | Maintains property’s existing condition |

The IRS uses these distinctions to determine how and when expenses can be deducted, so it’s important to classify them correctly.

IRS-Approved Expense Categories

The IRS allows landlords to deduct expenses that are considered both "ordinary" and "necessary" for managing, conserving, and maintaining rental property. Most landlords follow cash-basis accounting, meaning expenses are deducted when they are paid. Rental income and expenses are generally reported on Schedule E (Form 1040), though landlords who provide significant services to tenants or operate rental property as a business may need to use Schedule C (Form 1040) instead.

Depreciation is another important deduction. It lets you recover the cost of property improvements over 27.5 years, reducing your taxable rental income. Additionally, landlords who meet certain requirements may qualify for the Qualified Business Income (QBI) Deduction, which allows for an extra 20% deduction on qualified business income if the rental activity is treated as a trade or business or meets safe harbor rules.

To support your deductions, the IRS requires detailed documentation, such as receipts, bank records, and other proof of expenses. These records not only help during audits but also assist in tracking your property’s performance and preparing financial statements. Remember, improvements must be depreciated over time, while repairs can be deducted in the year they happen.

How to Track and Keep Records of Expenses

Keeping accurate records of your expenses is a must. Without clear tracking, you risk missing out on deductions, making tax preparation harder, and losing valuable data that could guide smarter financial decisions.

Setting Up Separate Bank Accounts

Keeping your personal and rental property finances separate is non-negotiable for both legal and tax reasons. Combining funds can cause serious problems, like compromising legal protections for LLC owners or triggering issues during IRS audits.

To stay organized, set up three distinct accounts:

- Operating account: For rent payments, repairs, and utilities.

- Security deposit account: Required by law to hold tenant deposits.

- Reserve account: To cover unexpected repairs or vacancies.

A good guideline for reserves is saving 10–20% of your monthly rent or $5,000–$10,000 per unit, depending on the property’s size and age.

Be sure to confirm your legal structure and secure an EIN (Employer Identification Number) to open business accounts.

When choosing a bank, look for low fees, strong online tools, and easy multi-account setup. Banks that integrate with property management software and offer real estate-specific reporting (like Schedule E categorization) can save you time and effort.

Once your accounts are ready, direct all rental income into your operating account and use it exclusively for property-related expenses. Automate transfers to your reserve fund and set up recurring payments for fixed costs like your mortgage and utilities. This ensures consistency and simplifies your financial management.

With your accounts in place, consider automating your tracking to make record-keeping even easier.

Using Digital Tools for Tracking

Digital tools can do wonders for simplifying expense tracking. Modern property management platforms can automatically categorize transactions, generate detailed reports, and sync directly with your bank accounts for real-time insights.

On average, landlords who use automated tools save 5–10 hours per month on manual bookkeeping.

For example, Renting Well’s cloud-based platform connects to your bank, categorizes expenses, creates profit and loss reports, and even stores digital receipts. These tools help you distinguish between capital and operating expenses, ensuring proper tax treatment. You can upload receipt photos through the mobile app, attach them to specific properties, and generate tax-ready reports. Plus, the platform tracks mileage for property visits and securely stores all documentation to meet IRS standards.

With a cloud-based system, you can update your records from anywhere – whether you’re inspecting a property or meeting with contractors. Automatic backups and multi-device access also safeguard your data from loss.

Keeping Proper Documentation

Even with automated tools, thorough documentation remains a cornerstone of good record-keeping. The IRS requires detailed records to support deductions, and having everything properly documented protects you during audits while maximizing your tax benefits.

For every expense, keep a receipt, invoice, or bank record. Digitize or file receipts immediately, including key details like the date, amount, and vendor. Organize these documents by property and category to make tax preparation a breeze.

Mileage logs are another area that needs attention since travel for property visits is deductible. Track the date, starting point, destination, business purpose, and total miles for each trip. You can use a GPS-enabled app or a manual log – just stay consistent.

Invoices from contractors should include detailed descriptions of the work done, materials used, and labor costs. Make sure they note the property address, completion date, and whether the expense qualifies as a repair (deductible immediately) or an improvement (depreciated over time).

Finally, your bank records serve as a critical documentation trail, which is why separate business accounts are so important. Reconcile your bank statements with your expense records monthly to catch errors and prevent fraud. Keep all records for at least seven years, as the IRS may audit returns up to six years after filing in some cases.

sbb-itb-9e51f47

Getting the Most Tax Deductions for Landlords

Boosting rental property profits often comes down to maximizing your tax deductions. The IRS allows landlords to deduct a wide range of legitimate business expenses, but understanding which ones apply to you – and keeping accurate records – can make a big difference in your bottom line.

Best Tax Deductions for Landlords

One of the most valuable deductions for rental property owners is depreciation. For instance, if your rental property is valued at $275,000 (excluding the land value), you could claim around $10,000 annually in depreciation deductions. This allows you to spread the cost of the property over its useful life, reducing your taxable income.

Repairs are another key deduction. Fixing broken fixtures or addressing structural issues qualifies as immediate tax relief. However, keep in mind that upgrades – like installing new kitchen cabinets or adding a deck – are considered improvements. These must be capitalized and depreciated over time instead of being deducted in a single year.

Don’t overlook mortgage interest. The interest on loans used to buy, maintain, or improve rental properties is fully deductible. Even closing points can be deducted, though they’re typically spread out over the life of the loan.

Travel expenses related to managing your rental properties are also deductible. In 2023, the IRS standard mileage rate is 65.5¢ per mile. Just be sure to keep detailed mileage logs to back up your claims.

Other deductible expenses include:

- Professional services: Fees for property management, legal advice, accounting, and real estate agent commissions.

- Insurance premiums: Costs for landlord insurance policies.

- Utilities: If you’re covering utilities for vacant units, these expenses are deductible.

- Property taxes and HOA fees: These are often substantial, so don’t miss out on claiming them.

- Advertising costs: Expenses for finding tenants, whether online or through traditional ads.

- Office expenses: This can include software subscriptions, office supplies, dedicated phone lines, or even part of a home office used exclusively for rental activities.

Safe Harbor Rules for Deductions

To make tax reporting simpler, the IRS provides safe harbor rules. For small landlords, the Small Taxpayer Safe Harbor allows you to immediately deduct repair and maintenance expenses as long as each expense doesn’t exceed $2,500 per invoice or item. You’ll need to make an election on your tax return and keep detailed records linking the expense to your rental property.

Routine maintenance – such as repainting, regular cleaning, or replacing worn-out components – can also be deducted right away, as long as it doesn’t count as a major improvement. These safe harbor provisions help landlords avoid the hassle of capitalizing and depreciating smaller expenses over several years.

Remember, these elections must be made every year on your tax return. Consulting a tax professional can help ensure you’re taking advantage of every eligible deduction.

How Software Makes Tax Reporting Easier

Modern property management software takes the headache out of tax reporting. Platforms like Renting Well automate the process of tracking expenses, ensuring compliance with IRS rules, and preparing the necessary forms.

For example, Renting Well automatically categorizes expenses, distinguishing between deductible repairs and depreciable improvements. It generates Schedule E-ready reports, organizing your income and expenses exactly as the IRS requires, which cuts down on manual work and reduces errors.

The platform also simplifies mileage tracking. Using GPS technology, it logs dates, destinations, and business purposes automatically, eliminating the need for paper logs while meeting IRS documentation standards.

Digital tools make expense tracking seamless, too. By integrating with your bank accounts, the software categorizes every transaction. You can even snap a photo of a receipt with your phone, and the system will extract key details – like vendor names, amounts, and dates – and link them to specific properties.

Depreciation calculations are another time-saver. The software tracks each property’s depreciable basis and calculates annual depreciation amounts, including adjustments for improvements. This ensures your deductions are accurate and aligned with IRS guidelines.

When tax season rolls around, year-end reports compile everything you need: profit and loss statements, depreciation schedules, and detailed breakdowns of expenses. This not only streamlines the filing process but can also help lower your tax preparation fees.

Using Software to Manage Expenses Better

Cloud-based platforms bring all your financial tools – spreadsheets, receipts, and bank statements – into one place. This not only reduces the risk of errors but also saves you time, allowing you to focus on growing your rental business.

Benefits of Cloud-Based Expense Tools

Cloud-based platforms go beyond simple automation, offering tools that make managing your finances easier and more efficient.

- Real-time expense tracking: With your bank accounts linked to the platform, transactions show up instantly on your dashboard. Whether it’s a small plumbing repair or an insurance premium, you can monitor expenses as they happen.

- Smarter categorization: These tools learn your spending habits, automatically categorizing transactions over time. For example, payments to your usual plumber might be filed under maintenance expenses, making budget planning much easier.

- Secure storage in one place: Forget digging through filing cabinets or email attachments. These platforms keep all your financial documents organized and accessible, whether you’re prepping for taxes or looking up an old warranty.

- Simplified multi-property management: If you manage multiple rental units, cloud-based tools let you track expenses for each property individually. This helps you see which properties are performing best and where improvements might be needed.

Integrate Digital Tools Daily

Start by linking your bank accounts to the platform. Most tools sync directly with major banks, so your transactions are automatically logged and categorized.

Take advantage of mobile features to snap pictures of receipts and extract the details instantly, cutting down on paper clutter.

Set up profiles for your go-to vendors – like contractors or utility companies – to ensure accurate expense tracking and to monitor spending trends.

Make it a habit to review your expense data weekly. This helps you catch errors early and ensures your financial records stay in sync with your accounting system, whether you handle it yourself or work with a bookkeeper.

Custom Reports for Growing Portfolios

As your rental portfolio grows, detailed reporting becomes essential for making informed decisions. Custom reports can provide deep insights into your financial performance.

- Property-specific profit and loss statements: These reports break down income and expenses for each rental unit, helping you pinpoint your most profitable properties. Tools like Renting Well make it easy to generate detailed P&L statements.

- Expense analysis: Custom reports can uncover spending patterns, helping you manage your budget better. Spotting trends in your categorized expenses might even open the door to negotiating better rates or adjusting your spending.

- Tax-ready documentation: When tax season rolls around, these tools organize your expenses into standard categories and create clear summaries you can share with your tax preparer, making the process much smoother.

Key Points for Landlords

Managing expenses effectively is what separates landlords who thrive financially from those who struggle. Success in this area depends on staying organized, planning strategically, and using the right financial tools.

Expense Management Basics Review

Let’s revisit the core principles of managing expenses. A clear understanding of the two primary expense types – operating expenses and capital expenses – is crucial. Operating expenses, like maintenance and utilities, are deducted annually, while capital improvements, such as major renovations, are depreciated over time.

The IRS’s Safe Harbor rules can be a game-changer for landlords who maintain thorough documentation. For expenses below $2,500 per invoice, these rules allow immediate deductions instead of requiring depreciation. This simplifies your bookkeeping and improves cash flow by letting you take deductions sooner.

Technology is another key ally in managing expenses. Cloud-based tools can sync with your bank accounts, automatically categorize transactions, and generate tax-ready reports. These features save time and provide real-time insights into your spending, helping you make smarter decisions about property upgrades or budget adjustments.

With these basics covered, it’s time to focus on practical steps to improve your financial management.

What Landlords Should Do Next

If you’re still tracking expenses manually with spreadsheets or paper receipts, now’s the time to upgrade to a digital system. Switching to a digital platform can save you money during tax season by capturing more deductions and reducing the need for costly accounting help.

Platforms like Renting Well are designed specifically for landlords managing multiple properties. They handle everything from automated expense categorization to detailed profit and loss statements for each unit. Whether you oversee a handful of rentals or a large portfolio, having all your financial data in one place simplifies decision-making and helps you maximize profits.

Start by linking your bank accounts to your chosen platform. This automation ensures no deductible expense goes unnoticed. Dedicate time each week to review categorized transactions and upload any cash receipts using mobile apps.

The most successful landlords treat expense management as an ongoing process, not just a task for tax season. Regular financial reviews can uncover spending patterns, help you negotiate better rates with vendors, and highlight opportunities for property upgrades that could increase rental income. By staying on top of your finances year-round, you’ll not only keep your records accurate but also improve your profitability.

FAQs

What’s the best way to differentiate between operating expenses and capital expenses for accurate tax deductions?

When it comes to separating operating expenses (OpEx) from capital expenses (CapEx) for tax purposes, it all boils down to the type of cost involved. OpEx covers the day-to-day expenses required to keep things running smoothly. Think of things like repairs, maintenance, utility bills, and property management fees. The good news? These costs are fully deductible in the same year you incur them.

CapEx, however, is a different story. These are the big-ticket, long-term investments – like major renovations, installing new appliances, or making structural upgrades. Unlike OpEx, you can’t deduct these costs all at once. Instead, they’re spread out over time through depreciation.

Getting this classification right isn’t just about staying on the right side of tax laws; it’s also key to maximizing your deductions. Keeping detailed records and working with a tax professional can make a world of difference in ensuring compliance and making the most of your expenses.

How can digital tools like Renting Well help landlords manage rental property expenses more accurately and efficiently?

Digital tools like Renting Well take the hassle out of managing rental property expenses by automating tasks like data entry, tracking, and reporting. This not only cuts down on human error but also ensures financial records are more accurate. With features like real-time expense tracking and automated financial reports, landlords can save valuable time while gaining a clear view of their property’s financial health.

By reducing the need for manual calculations and simplifying workflows, tools like Renting Well make expense management quicker and more efficient. They also keep financial records organized and current, giving landlords the insights they need to make informed decisions and boost profitability.

How can I organize my rental property finances and stay compliant with IRS rules?

To manage your rental property finances effectively and stay in line with IRS rules, it’s crucial to start by accurately reporting all rental income on your tax return. Typically, this is done using Schedule E (Form 1040). Keep detailed records of everything – rental income, mortgage interest, property taxes, repairs, and depreciation. These records are essential for reducing your taxable income.

Be consistent when categorizing expenses and maintain thorough documentation throughout the year to back up any deductions you claim. It’s also important to understand IRS guidelines on depreciation and ensure that expenses are deducted in the year they are incurred. Staying organized and keeping solid records not only helps you maximize your tax benefits but also minimizes the risk of running into audit troubles.