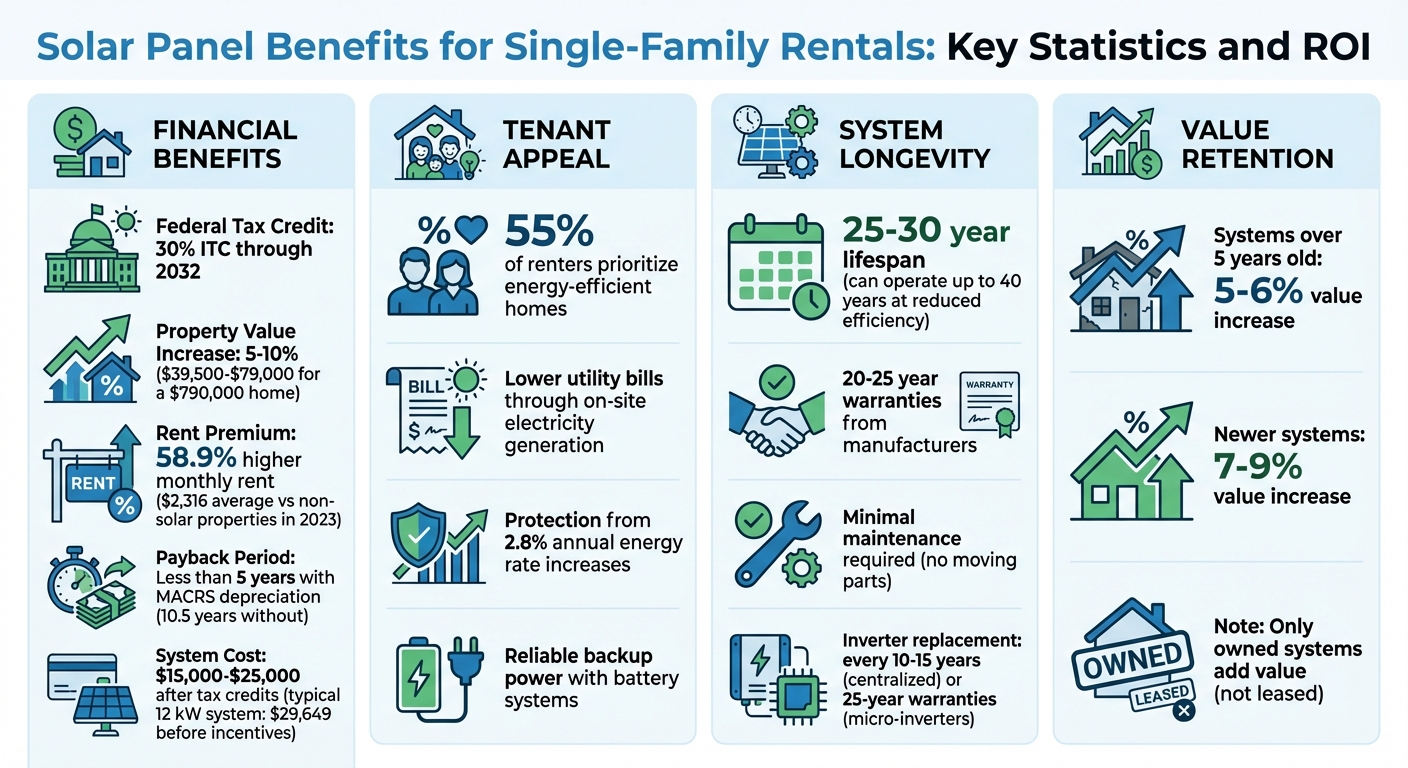

Solar panels are becoming a smart choice for single-family rental property owners. They help reduce energy costs, attract eco-conscious tenants, and increase property value. Here’s why they make sense:

- Lower Costs: Solar panels cut electricity bills for landlords and tenants. Federal incentives, like the 30% tax credit, make installation more affordable.

- Higher Rent Potential: Rentals with solar systems earned nearly 59% more in monthly rent in 2023 compared to those without.

- Increased Property Value: Solar panels can add $15,000 or more to a home’s resale value.

- Tenant Appeal: Over half of renters prioritize energy-efficient homes, and solar panels lower utility bills while offering reliable backup power with battery systems.

- Affordable Installations: Costs for residential solar systems have dropped significantly, with prices now ranging from $15,000 to $25,000 after tax credits.

Solar panels are a win-win for landlords and tenants, offering financial savings, higher property value, and an edge in competitive rental markets.

Solar Panel Benefits for Single-Family Rentals: Key Statistics and ROI

Main Benefits of Solar Panels for Single-Family Rentals

Lower Operating Costs and Improved Cash Flow

For landlords who include utilities in the rent, solar panels can slash electricity costs right away. By generating your own power and selling any extra back to the grid through net metering, you can see a direct boost in your monthly cash flow.

Federal programs like the 30% Investment Tax Credit (ITC) and the Modified Accelerated Cost Recovery System (MACRS) make the initial investment much more manageable. MACRS allows you to depreciate the cost of solar equipment over five years, offering valuable tax deductions along the way.

Attracting Tenants and Supporting Higher Rents

Solar panels do more than just cut costs – they make your property more attractive to potential tenants. They help justify higher rents by reducing utility expenses and appeal to eco-conscious renters, which can lower turnover rates. And the numbers back this up: single-family rentals with solar energy commanded an average monthly rent of $2,316 in 2023 – 58.9% higher than non-solar properties.

"A solar-powered building is also a great marketing tool when it comes to renting out your unit: solar appeals to a growing segment of residents who care about the environment, and installing a solar energy system can help you attract tenants." – EnergySage

Adding battery storage to a solar system offers even more value. It provides backup power during outages, giving tenants a level of reliability and comfort that traditional rentals just can’t match.

Boosting Property Value

Solar panels don’t just save money – they also increase the overall value of your property. Among home improvements, solar installations deliver some of the best returns. In fact, they can often pay for themselves by driving up property value. For a home priced at $790,000, solar can add between $39,500 and $79,000 to its resale value.

Ownership is key here. Homes with owned solar systems typically see value increases of 5% to 10%, while leased or third-party-owned systems often add no value and may even complicate a sale. Even older systems hold their worth – installations over five years old can still add 5% to 6% in value, while newer systems see increases of 7% to 9%. This makes solar panels not just an energy solution but a smart long-term investment that enhances the overall marketability and worth of your property.

Addressing Common Concerns: Cost, Maintenance, and Risks

Installation Costs and Available Incentives

When installing solar panels, the upfront expenses typically include the cost of hardware, professional installation, grid connection fees, local permits, and sales tax. However, the Investment Tax Credit (ITC) offers a 30% offset on system costs for installations completed through 2032, with gradual reductions in the years that follow.

Landlords can also take advantage of a 10% annual depreciation benefit and may qualify for additional state rebates, utility programs, or Renewable Energy Certificates (RECs). For those looking to minimize upfront costs, solar leases or Power Purchase Agreements (PPAs) provide an option to install panels with little to no money down, though the tax credits remain with the third-party owner.

To ensure you’re making the best investment, get at least three bids from NABCEP-certified installers and confirm whether your utility company offers net metering. Beyond the initial costs, minimal maintenance and strategic planning can further enhance the value of your solar system.

Maintenance Requirements and Panel Lifespan

Solar panels are known for their low-maintenance requirements, which pair well with the financial benefits they offer. With no moving parts, they demand very little upkeep. Most panels have a lifespan of 25 to 30 years, and even after that, they can continue generating electricity – albeit at a reduced efficiency – for up to 40 years. Typically, manufacturers provide warranties ranging from 20 to 25 years.

While the panels themselves are durable, other components like centralized string inverters may need replacement every 10 to 15 years. Micro-inverters, on the other hand, often come with warranties that can last up to 25 years. Routine maintenance, such as periodic cleaning and inspections, generally incurs minimal costs. If you opt for a solar lease, ensure the agreement clearly outlines who is responsible for maintenance to avoid any misunderstandings later.

Evaluating Roof Condition and Installation Timing

Before installing solar panels, it’s crucial to assess the condition of your roof. A structurally sound roof not only minimizes risks but also ensures you can maximize the long-term benefits of your solar system. If your roof is nearing the end of its lifespan – say, within the next five to ten years – consider replacing it first to avoid the added expense of removing and reinstalling panels down the line. Additionally, verify that your roof can handle the weight of the system and accommodate any necessary repairs.

For optimal energy production in the U.S., south-facing roofs are ideal. Be sure to evaluate potential shading from nearby trees or buildings, factoring in future growth or construction that could impact sunlight exposure. It’s also important to review HOA guidelines or local building codes, as many states have "solar rights provisions" that limit restrictions on solar installations. Tools like Google Project Sunroof or the NREL PVWatts calculator can help you estimate your property’s solar potential using satellite imagery and weather data. By carefully timing your installation and ensuring your roof is ready, you can reduce risks and protect the added property value that solar panels can bring.

Should You Install Solar Panels on Your Rental Property?

sbb-itb-9e51f47

How Solar Panels Benefit Tenants

Solar panels don’t just boost landlords’ property value and cash flow – they also bring meaningful advantages to tenants, from slashing utility bills to offering peace of mind during power outages.

Lower Utility Bills and Predictable Energy Costs

Solar panels produce electricity right on-site, reducing the need to buy as much power from utility companies. With net metering, any excess energy generated during the day flows back to the grid, offsetting costs for nighttime or cloudy-day energy use.

Tenants can save even more by timing energy-heavy activities, like running the dishwasher or doing laundry, during peak sunlight hours when solar output is strongest. Adding a battery storage system takes these benefits further by storing surplus energy generated during the day for use at night, cutting reliance on the grid even more. Plus, solar systems often come with fixed electricity rates, shielding tenants from rising utility costs and making monthly budgeting easier. These savings not only reduce financial stress but also make solar-equipped properties more attractive to renters looking for eco-friendly and cost-effective living options.

Attracting Environmentally Conscious Renters

For Millennials and Gen Z renters, sustainability is a top priority. Research shows that 55% of renters actively look for eco-friendly features in their homes. Solar panels act as a visible indicator of a forward-thinking, energy-efficient property, helping it stand out in a crowded rental market.

"Tenants who benefit from lower energy expenses are more likely to stay." – Triumph Property Management

Solar-equipped properties align perfectly with the values of environmentally aware renters, who often seek to minimize their carbon footprint. This alignment not only attracts tenants but also leads to higher retention rates and fewer vacancies for landlords. Highlighting benefits like reduced bills and sustainability in rental listings can draw in tenants willing to pay more for a greener lifestyle.

Reliable Backup Power During Outages

Solar panels can also enhance reliability for tenants, especially when paired with battery storage systems. While solar panels alone don’t work during blackouts, a battery system can keep essential appliances running when the grid goes down. This feature is particularly valuable in areas with frequent outages or extreme weather, offering tenants a sense of security and convenience.

Battery systems can be customized to provide backup power for critical appliances or even the entire home. Landlords can use property tours to explain how these systems work, building trust and justifying higher rents. For tenants in regions prone to power disruptions, this added reliability becomes a standout amenity, improving satisfaction and increasing the likelihood of lease renewals.

Steps for Installing Solar Panels for Single-Family Rentals

Evaluating Feasibility and Return on Investment

Start by conducting an energy audit and reviewing the last 12 months of utility bills to determine your annual energy consumption in kilowatt-hours (kWh). This step ensures you can properly size your solar system, avoiding unnecessary costs from overestimating your energy needs.

Next, confirm that your roof meets the criteria for optimal solar performance, such as adequate sunlight exposure and structural integrity. You can use online tools to estimate your property’s solar potential.

For context, a typical 12 kW solar system costs around $29,649 before incentives. The 30% federal tax credit can significantly reduce this expense. If you purchase the system outright, you can expect to break even in about 10.5 years. For rental properties, using MACRS depreciation can lower the payback period to less than five years. To ensure you get the best deal, obtain quotes from at least three NABCEP-certified installers. Compare their cost-per-watt rates and projected annual energy production. Also, check whether your local utility offers net metering, which allows you to earn credits for any surplus energy your system generates and sends back to the grid.

These steps are essential for laying the groundwork to maximize the financial benefits of your solar investment.

Structuring Lease Terms for Solar-Equipped Properties

How you structure your lease will depend on who pays the electric bill. If you keep the electric bill in your name, the solar system can reduce your operating expenses. This allows you to offer a higher, flat-rate rent that includes electricity. On the other hand, if tenants are responsible for their own utility bills, you can justify a rent premium by emphasizing the savings they’ll see on their energy costs.

"To account for the upfront costs of installing solar, landlords and owners can charge additional rent and advertise that utilities are included." – Kaycee Miller, Rentec Direct

Make sure your lease specifies who is responsible for paying for electricity, how net metering credits will be handled, and whether tenants have any responsibilities related to monitoring the solar system. If you choose a solar lease or a power purchase agreement (PPA), remember that a third party owns the system. In this case, either you or your tenant will need to cover a fixed monthly fee or pay for the electricity generated at a discounted rate.

Using Property Management Software for Solar Tracking

After installing your solar system, it’s important to track its performance to maximize its benefits. Many solar providers offer proprietary software that monitors energy production and system health in real time. Additionally, property management platforms like Renting Well can serve as a central location for organizing important documents like installation records, interconnection permits, and warranties.

Use your property management software to track warranties, tax credits, Renewable Energy Certificates (RECs), and net metering savings. This makes reporting and monitoring your return on investment much easier. You can also set reminders for regular inspections or professional cleanings, ensuring your system continues to operate at peak efficiency.

Conclusion: Solar Panels Benefit Landlords and Tenants

Solar panels offer landlords a chance to see strong financial returns, thanks to incentives like the 30% federal tax credit and MACRS depreciation. These benefits can reduce payback periods to less than five years. Additionally, solar installations increase property values by 4%–10%, which translates to an added $39,500 to $79,000 on a home valued at $790,000 – far surpassing the typical 50–60% return on investment seen with kitchen or bathroom upgrades.

For tenants, the advantages are clear: lower monthly utility bills and insulation from the historical 2.8% annual rise in energy rates. This creates a mutually beneficial arrangement – landlords can justify higher rents while tenants enjoy real savings. Plus, properties with solar panels attract the growing number of renters (55%) who prioritize eco-friendly features when selecting a home.

"Solar panels are viewed as upgrades, just like a renovated kitchen or a finished basement." – Lawrence Berkeley National Laboratory

Concerns about costs and maintenance are manageable. Solar systems come with warranties lasting 20–25 years, ensuring decades of affordable energy after the initial investment. By evaluating feasibility and setting clear lease terms, landlords can maximize their financial gains.

Tools like Renting Well make it easier to track warranties, tax credits, and system performance, simplifying the process of monitoring returns. With equipment costs at historic lows and incentives locked in through 2032, now is an excellent time to consider solar for single-family rentals.

FAQs

Can installing solar panels increase the rent for single-family rentals?

Adding solar panels can often support a slight rent increase. Many tenants are open to paying a bit more for homes that offer lower electricity bills and eco-friendly benefits. In some markets, this might translate to an additional couple of hundred dollars each month. Solar panels not only appeal to renters who value sustainability but also enhance the long-term worth of your property.

What kind of maintenance do solar panels need on rental properties?

Solar panels are a hassle-free addition to rental properties, requiring only a bit of routine care to keep them in top shape. For landlords, the main upkeep involves occasional cleaning to clear away dirt and debris, trimming back trees or shrubs to prevent shading, and visual inspections to spot any signs of damage or wear.

While the panels themselves are built to last, inverters typically need replacing every 5–10 years. Adding critter guards is another smart move to protect the system from pests. Most solar panels come with warranties that cover repairs for manufacturing defects or performance concerns, which can offer some extra reassurance. Keeping an eye on energy output regularly is also a good way to confirm the system is running smoothly.

Do solar panels boost the resale value of rental properties?

Yes, installing solar panels can boost the resale value of a rental property. Research shows that solar installations can add about $5,900 per kilowatt (kW) of installed capacity to a home’s value. In some cases, properties equipped with solar panels have experienced value increases as high as $79,000.

For landlords, this means solar panels aren’t just an eco-friendly upgrade – they’re a strategic investment. They enhance a property’s appeal and can improve profitability over time, particularly in areas where energy efficiency is highly valued.