Maximize Your Property Returns with a Rental Yield Calculator

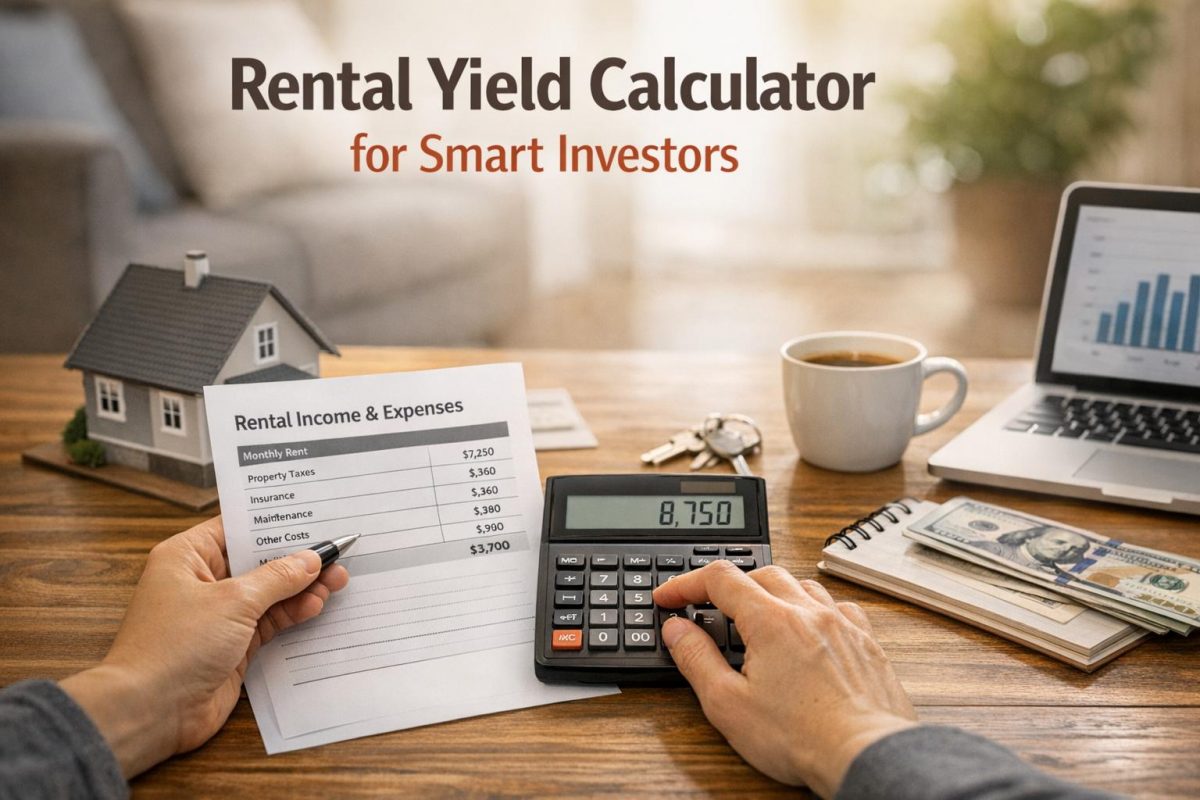

Investing in real estate can be incredibly rewarding, but only if you’ve got the right data to back your decisions. That’s where a tool to assess rental profitability comes in handy. It takes the guesswork out of evaluating potential investments by giving you a clear percentage that reflects your annual return based on rent and costs.

Why Calculating Property Returns Matters

Understanding the financial performance of a rental property is crucial before signing on the dotted line. By factoring in the purchase price, monthly income from tenants, and yearly expenses like taxes or repairs, you get a snapshot of whether the investment makes sense. This kind of insight helps you compare different properties or even decide if real estate is the right move compared to other opportunities.

Beyond the Numbers

While a solid percentage is a great starting point, don’t forget the bigger picture. Market conditions, property location, and future appreciation all play a role. Use this analysis as your foundation, then dig deeper into local trends to ensure you’re making a smart, informed choice. With the right approach, you’ll build a portfolio that delivers steady returns for years to come.

FAQs

What is rental yield, and why does it matter?

Rental yield is a measure of how much profit a property generates from rent, expressed as a percentage of its purchase price. It’s a key metric for investors because it shows whether a property will provide a good return compared to other investments. A higher yield often means a better cash flow, but you’ll also want to consider location, market trends, and long-term growth potential when making decisions.

What’s considered a good rental yield for a property?

A ‘good’ rental yield depends on your market and goals, but generally, anything above 5-6% is considered decent for most areas. In high-demand urban markets, yields might be lower due to higher property prices, while rural or up-and-coming areas could offer 8-10% or more. Always compare your yield to local averages and factor in risks like vacancy rates or unexpected repairs.

Can I use this tool for commercial properties too?

Absolutely, this calculator works for any type of rental property—residential or commercial. Just make sure you’ve got accurate figures for purchase price, monthly rent, and annual expenses. The formula stays the same, so you’ll get a clear picture of the yield regardless of property type. If you’ve got unique costs for commercial spaces, like longer vacancies, keep those in mind when interpreting the results.