You just showed one of your available units to an individual who’s made a great first impression. They’re employed, presentable, and they claim they’ve had a fabulous relationship with their previous landlord. Ok. Seems safe right? Then you check their credit, and discover they have a low credit score. Lots of landlords and property managers will be quick to tell you – forget it. If their credit is low, you’ll probably have a problem. Hold on a second – don’t write them off just yet.

There’s a great article about this by Kay Cleaves at Straw Stick Stone.

As you might know, credit scores only get higher when you borrow and pay back assorted lenders repeatedly. The best tenant theoretically is one who doesn’t engage in risky borrowing beyond their means, and is likely to have a very thin credit history. The part of the credit score that most landlords are interested in is the payment history component. It is possible to have a perfectly great tenant who pays his bills on time, had a great relationship with a past landlord, and is responsible, but has a low credit score. Keep in mind that the average tenant is usually younger, less experienced and less wealthy than a homeowner.

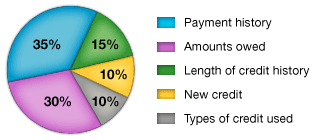

The payment history only accounts for 35% of the total pie, so in other words, while checking credit is something I’m a huge advocate of doing, just looking at the credit score isn’t the most effective way of determining you’re dealing with a potential problem tenant.

If you’re being diligent, you should be asking for a landlord reference. Calling a former landlord, or as many former landlords as you can, and getting a sense of how that relationship was is also an effective gauge on what kind of tenant you’re going to have. Asking them questions about the previous tenancy, how they kept the place, etc is a must. From personal experience, I’ve been renting to an individual who had a low credit score when I initially showed him the available unit, but who I’ve never had an issue with payment wise, or for anything else. I spoke with their previous landlord and they provided a glowing account of a quiet and reliable individual who was recently out of school and had been working at the same place for more than 2 years. Speaking with the prospective tenant is another good way to get a sense. If a credit score is low, maybe there’s reasons for that. Maybe they’re new with credit, but a seasoned and responsible renter. Maybe they’ve recently applied and received new credit. Maybe they’re paying down some debts that were previously high. There’s an assortment of reasons why a credit score could be lowered that don’t reflect how an individual is with their landlord. Covering all the bases when deciding to rent to someone needs to be done – but basing an assumption on a 3 digit number, of which 35% of that number is what you’re really concerned with, might not be the most effective way in getting the tenant you want.

What do you think? Do you base tenancy decisions on payment history only? Share your thoughts.