Managing leases manually is time-consuming and error-prone. Automation simplifies the process, saving you time and reducing mistakes. Here’s what automating lease management can do for you:

- Save Time: Cut administrative workload by up to 60%. Tasks like rent collection, tenant communication, and lease renewals become faster and easier.

- Reduce Errors: Automation minimizes mistakes, improving compliance with legal requirements and reducing risks.

- Boost Tenant Satisfaction: Features like online maintenance requests and automated reminders improve tenant retention by up to 15%.

- Improve Cash Flow: Automated rent collection ensures 99% on-time payments compared to 88% with manual methods.

- Streamline Renewals: Digital lease renewals cut processing time by 43% and reduce vacancy rates by 12%.

Automation tools like Renting Well help property managers digitize lease templates, set up workflows, and track key dates. Whether it’s automating reminders, organizing documents, or analyzing data, these tools make lease management efficient and scalable.

8 essential lease management software features

Setting Up Automated Lease Workflows

Automating workflows in lease management can turn a time-consuming process into an efficient system that handles repetitive tasks with minimal effort. These workflows rely on triggers, decision rules, automatic actions, and defined outcomes. By reducing manual input, they help cut down on errors, ensure consistency, and free up time for more strategic priorities. Tools like Renting Well provide the necessary foundation to create these automated processes. To get started, digitize your lease templates to enable a smooth digital workflow.

Converting Lease Templates to Digital Format

The first step in setting up automation is converting your paper-based lease agreements into digital formats. Digital leases are easier to access, more secure, and support remote management for better communication. Begin by gathering your current lease templates, focusing on the ones you use most often. Many property management platforms allow you to upload these documents and turn them into interactive versions with fillable fields and electronic signature options.

When digitizing, prioritize customization. Digital templates let you tailor agreements to specific tenant needs or property conditions – something that’s much harder to do with paper documents. For instance, you can create separate templates for different property types and include details like rent amounts, lease terms, and tenant responsibilities. While maintaining standard lease terms, these templates can also be adjusted for shorter or longer lease periods as needed.

Creating Automated Workflows

To build effective workflows, start by mapping your current processes – such as leasing, renewals, or tenant communication – and identify the triggers and outcomes for each step. This helps create a seamless flow where one action naturally leads to the next. For example, when a prospective tenant submits an application, the system could automatically initiate a background check, generate lease documents, and schedule property viewings.

Set clear rules to avoid confusion. For instance, you might define criteria for automatic lease approval based on factors like credit scores, income verification, or rental history. Many modern property management tools also allow you to add electronic signature fields to documents, so tenants can complete lease agreements remotely. To make sure your workflows remain effective, include feedback mechanisms to monitor performance and tenant satisfaction. Additionally, integrate automated reminders to ensure you never miss critical lease deadlines.

Setting Up Lease Date Reminders

Automated reminders are a key feature of lease workflow automation, helping to prevent missed deadlines and any resulting penalties. Lease management software can track important dates and send alerts well in advance. To make these reminders effective, focus on customization and timing. Notifications can be delivered via email, dashboard alerts, or mobile notifications, ensuring you stay informed wherever you are.

Set reminders to trigger at multiple points before key dates. For example, you might schedule an initial alert 90 days before a lease expires, followed by additional reminders as the deadline gets closer. Advanced systems even use AI to personalize notifications and provide real-time tracking. Automating reminders for critical dates – such as lease start dates, renewal deadlines, rent increase notices, and move-out dates – creates a reliable system that improves both operational efficiency and tenant satisfaction.

Automating Lease Renewals and Reminders

Automating lease renewals has turned a traditionally tedious administrative task into an efficient, streamlined process that benefits both landlords and tenants. By automating workflows, property managers can cut down on paperwork, ensure timely communication, and improve tenant retention rates.

Automatic Renewal Notifications

Property management software can track lease expiration dates and automatically send notifications to landlords and tenants well before deadlines, avoiding last-minute surprises. Personalization plays a key role in making these notifications effective. In fact, over 70% of tenants prefer personalized renewal notices over generic ones. Modern platforms use tenant behavioral data – like payment history and communication preferences – to tailor these messages, which not only enhances tenant satisfaction but also increases the likelihood of successful renewals.

Properties using automated renewal platforms have reported a 15% drop in tenant turnover. These platforms can schedule notifications at multiple intervals, ensuring tenants are consistently informed. Additionally, integration with various communication channels – such as email, SMS, or in-app messaging – ensures tenants receive updates in their preferred format. Renting Well, for instance, supports multi-channel notifications to meet tenant preferences.

Digital Lease Renewals

Digital lease renewals simplify the process by allowing tenants to review, negotiate, and sign agreements online via platforms like Renting Well’s resident portal. This eliminates the need for in-person meetings and cumbersome paperwork.

The shift to digital renewals has significantly cut down on processing time. According to LeasingAutomation.co, property management firms using their platform reduced time spent on renewals by an average of 43% compared to firms relying on manual methods. These efficiency gains stem from features like automated document generation, electronic signatures, and real-time data updates. The process typically includes pre-filled tenant information, customizable renewal terms based on market trends, and remote signing capabilities. Multifamily properties utilizing digital renewal systems saw a 12% reduction in vacancy rates compared to those using manual processes.

To implement digital renewals successfully, integration with existing property management systems is essential to maintain data consistency. Staff training also plays a critical role. Microlearning techniques can help teams quickly adapt to new systems, while a phased rollout minimizes disruptions and allows for adjustments as needed.

Automatic Rent Adjustments

After digital renewals, automated rent adjustments further simplify the leasing cycle. Advanced platforms use AI to calculate rent changes based on market trends and local regulations. This automation can improve renewal rates by approximately 6% while delivering a strong return on investment.

These systems can tailor rent adjustments to specific factors like tenant history, unit type, and market performance. For example, long-term tenants with a solid payment history might see smaller increases, while newer tenants or premium units may face standard market-rate adjustments. The software also tracks key metrics such as renewal acceptance rates, decision times, and how renewal pricing compares to the market, offering valuable insights for refining strategies.

Clear communication is crucial when introducing automatic rent adjustments. Providing advance notice – beyond what’s legally required – and offering transparent explanations help maintain positive tenant relationships. Gradual increases tend to be more acceptable than sudden, large hikes. Regular review cycles ensure renewal workflows stay aligned with both business goals and tenant expectations, while ongoing analysis of renewal data highlights areas where automation excels and where manual adjustments might still be beneficial.

sbb-itb-9e51f47

Document Storage and Compliance Management

Centralizing and automating document storage not only improves efficiency but also minimizes risks.

Cloud-Based Document Storage Benefits

Cloud-based storage has transformed how lease documents are managed. By moving away from physical files, property managers can eliminate the costs of off-site storage and free up physical space. Even better, cloud storage allows for easy, remote access to critical documents, making team collaboration and remote work much smoother.

A 2023 study highlights that organizations saw 40% productivity gains and made decisions 50% faster using cloud-based solutions. Enhanced security features like encryption and controlled access reduced data breaches by 40%. On top of that, these systems helped cut costs by up to 25%, improved operational efficiency by 30%, and removed the need for expensive on-site IT infrastructure. Businesses using cloud platforms also reported a 60% increase in scalability.

Cloud solutions go beyond just secure storage – they enable real-time collaboration, which traditional methods lack. For example, Renting Well’s cloud-based storage system provides secure access to lease documents while supporting modern property management teams’ collaborative needs.

Once documents are securely stored in the cloud, organizing them effectively becomes the next step.

Organizing and Finding Lease Documents

Storing documents in the cloud is only half the battle – proper organization ensures you can find what you need quickly. Using a consistent folder structure and clear naming conventions can make all the difference. For instance, property managers might organize files into categories like tenant information, lease agreements, property maintenance, financial records, and legal documents. A file naming format such as "123MainSt_Lease_Smith_01152024.pdf" instantly communicates key details.

Metadata tagging takes organization a step further. By tagging files with relevant details like tenant names, property addresses, or lease dates, managers can streamline searches and easily connect related documents. Many cloud storage solutions, especially those integrated with property management tools like Renting Well, offer advanced search features. These tools can locate files by tenant name, property address, date range, or document type in just seconds.

Meeting Lease Compliance Requirements

Automation doesn’t just improve workflows – it also ensures leases meet all necessary legal standards. With federal, state, and local regulations constantly evolving, manual compliance tracking can be both time-consuming and risky.

Modern software automatically updates lease templates to align with changing regulations. For example, federal compliance includes adhering to the Fair Housing Act, which prohibits discrimination based on race, color, national origin, religion, sex, familial status, or disability. Additionally, landlords of properties built before 1978 must provide tenants with a Lead-Based Paint Disclosure form and notify them of potential radon gas risks.

Property management tools streamline compliance by managing templates, tracking updates, and maintaining audit trails that record when documents are created, modified, or signed. These systems can even flag overly complex legal language and suggest simplified alternatives to prevent misunderstandings. Regular reviews – sometimes with legal counsel – ensure lease agreements remain up-to-date and compliant.

Using Reports and Data to Improve Lease Management

Integrating data analysis into lease management elevates it from a routine task to a strategic operation. Instead of relying on guesswork, data allows property managers to make informed decisions. Modern property management software plays a vital role here, offering detailed reports that highlight patterns, inefficiencies, and opportunities that might otherwise go unnoticed.

Tracking Lease Performance Data

Monitoring key metrics is essential for effective lease management. Metrics like occupancy rates, lease durations, rent collection efficiency, maintenance response times, cash flow, ROI, and tenant turnover provide valuable insights. For instance, properties with 90% occupancy and lease terms extended by six months have been shown to increase revenue by 10–15% while reducing leasing expenses by 25%. Rent collection efficiency is another critical area – an optimal rate of 95% is often the benchmark. Automated systems can help achieve this by cutting late payments by up to 15% and boosting revenue by a similar margin.

Comprehensive reporting dashboards make it easier to interpret this data. These tools consolidate lease terms, financial details, and key dates into visual formats, helping property managers see the bigger picture. This builds on the benefits of automation, further streamlining lease processes.

Finding Process Problems

Data doesn’t just reveal problems – it also helps address them proactively. Analytics can identify bottlenecks and inefficiencies that drain resources or frustrate tenants. For example, analyzing lease data can highlight which agreements are underperforming or incurring unexpected costs. Centralized digital documentation can reduce the time spent searching for lease details by 30% and speed up vacancy filling by 40%.

Compliance risks are another area where systematic tracking can help. Studies show that outdated agreements affect 20% of leases, but proper training and automation can reduce these issues by 25%. Automating tasks like lease renewals and rent collection minimizes errors by up to 50%, while automated reminders for lease expirations can increase tenant renewal rates by at least 20%. Tenant turnover is a costly issue too – vacancies can eat up 20–30% of annual rent per unit. However, effective expense tracking can reduce operational costs by around 10%.

Using Data for Better Decisions

Predictive analytics takes lease management to the next level by shifting from reactive to proactive strategies. For example, understanding tenant preferences allows property managers to offer personalized services, which can improve occupancy rates. Predictive tools can also forecast vacancy patterns, enabling targeted marketing and retention efforts. Analyzing market trends helps property managers set competitive rental prices, with experts recommending an annual lease renewal increase of 3–5% to stay competitive, especially when occupancy rates dip below 85%.

Tenant payment history is another valuable data source. It can help identify tenants at risk of default, allowing managers to address potential issues early. Even small improvements in tenant satisfaction – just a 1% increase – can lead to a 10% rise in retention rates. Additionally, tenants who receive renewal offers 90 days before their lease ends are 25% more likely to renew.

The growing reliance on analytics is reflected in market trends. The global lease management market is projected to reach $5.65 billion in 2024, with an expected annual growth rate of 6.4% from 2025 to 2030. Advanced analytics and Business Intelligence tools are empowering property managers to better analyze lease portfolios, predict trends, and make more informed decisions. This data-driven approach enhances earlier gains in renewals and compliance, ensuring ongoing improvements in lease management processes.

Conclusion

Automated lease management is reshaping the way property managers handle daily operations, making processes more efficient, scalable, and profitable. By leveraging data insights and streamlining workflows, automation is setting a new standard for lease management.

For instance, automation can cut property managers’ workloads by as much as 60%, particularly in areas like rent collection and lease renewals. Over 50% of property managers have reported noticeable cost savings after adopting property management software, and 81% of renters have expressed greater satisfaction with these digital tools.

Industry voices reinforce this shift:

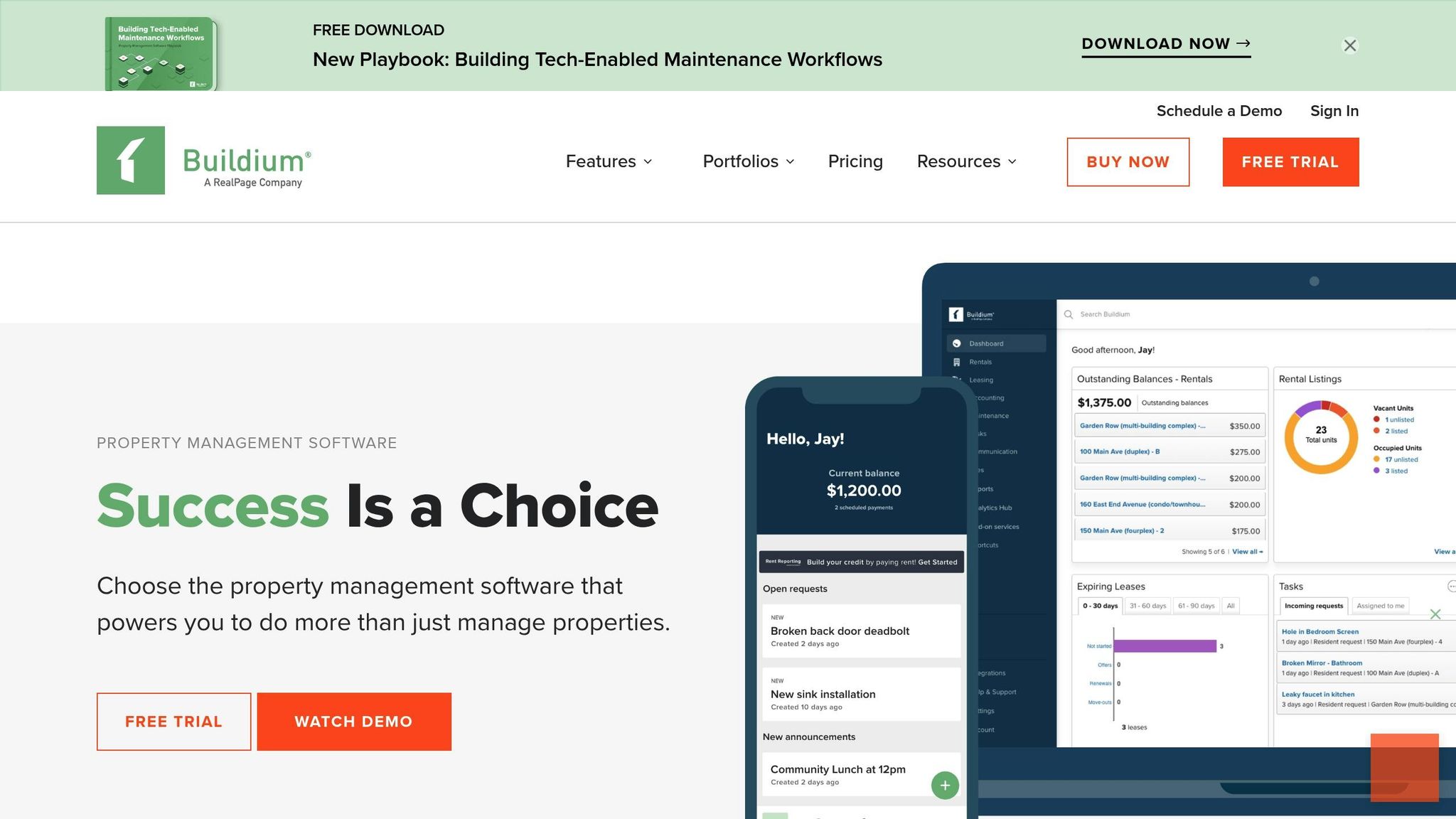

"The property management industry has changed a lot in recent years. Today, automation stands out as one of the best tools residential property managers can use to improve their operations and enhance residents’ experiences. Automation handles repetitive tasks, cuts down errors, and saves time. This allows managers to focus on activities that grow their business and strengthen resident relationships." – Jake Belding, Content Marketing Specialist at Buildium

Cloud-based platforms like Renting Well further enhance operations by providing real-time access to lease data, reducing IT expenses, and improving security.

The benefits are clear: automated systems optimize rent collection, reduce delinquencies, and lower vacancy rates. They also free up staff to focus on building stronger relationships with tenants, who benefit from features like self-service portals. Property managers using automation have seen a 40% improvement in response times to tenant inquiries, which directly boosts satisfaction and retention.

Meanwhile, manual processes are becoming a liability. Companies that embrace data-driven tools consistently outperform those relying on outdated, low-tech methods. Automation today can handle everything from lease renewals and compliance tracking to document storage and analytics, enabling smarter, faster decision-making.

The real question isn’t whether to automate – it’s how soon you can adopt these tools to enjoy fewer errors, happier tenants, and higher profitability. Modern property management is here, and automation is leading the way.

FAQs

How does automating lease agreement management help reduce errors and ensure legal compliance?

Automating lease agreement management helps cut down on mistakes by simplifying and standardizing tasks like creating documents. This reduces the need for manual data entry, which is often where errors and inconsistencies creep in. By keeping all lease-related tasks in one place, automation ensures important details are recorded and managed with precision.

It also plays a big role in staying on top of legal compliance. Tasks like lease renewals, deadline alerts, and tracking regulatory requirements can be automated, ensuring your agreements meet legal standards. This reduces the chances of fines, disputes, or other legal headaches. Plus, with accurate records and proactive compliance tracking, you save time and avoid costly missteps.

How can I digitize and automate paper-based lease agreements?

To turn your paper-based lease agreements into a digital and automated system, begin by scanning your physical documents. You can use a scanner or a mobile app to create clear digital versions. After that, apply Optical Character Recognition (OCR) technology to pull out essential details like tenant names, lease dates, and terms from the scanned files. Once you’ve extracted the data, organize it using a property management software such as Renting Well. This platform allows you to store documents securely, set up automated renewal reminders, and simplify your lease management tasks. The result? A more efficient system that saves time and keeps your records easily accessible and well-protected.

How can property managers use data analytics to improve lease management?

Data analytics empowers property managers to simplify lease management by offering clear insights into critical metrics like occupancy rates, tenant turnover, rent collection efficiency, maintenance costs, and tenant satisfaction scores. Tracking these metrics helps managers spot trends, anticipate future needs, and tackle potential problems before they grow into larger issues.

By leveraging these insights, property managers can enhance tenant retention, streamline daily operations, and boost overall profitability. Tools like property management software can automate much of this process, making it easier to monitor performance and make informed, data-backed decisions.