In 2025, managing properties is all about efficiency and tenant satisfaction. Cloud-based platforms are now the standard for streamlining communication between property managers and tenants. These tools centralize tasks like rent payments, maintenance requests, and document sharing, making life easier for everyone involved. Here’s what you need to know:

Key Features to Look For:

- Messaging Tools: In-app messaging, email, and SMS for easy communication.

- Mobile Access: Manage tasks anytime, anywhere with full app functionality.

- Maintenance Tracking: Submit requests with photos, assign tasks, and track progress.

- Document Storage: Securely store and share leases, policies, and receipts.

- Automated Alerts: Notifications for rent, maintenance updates, and more.

- Integration: Connect with accounting, marketing, and other tools.

- Data Security: Encryption, two-factor authentication, and compliance with regulations.

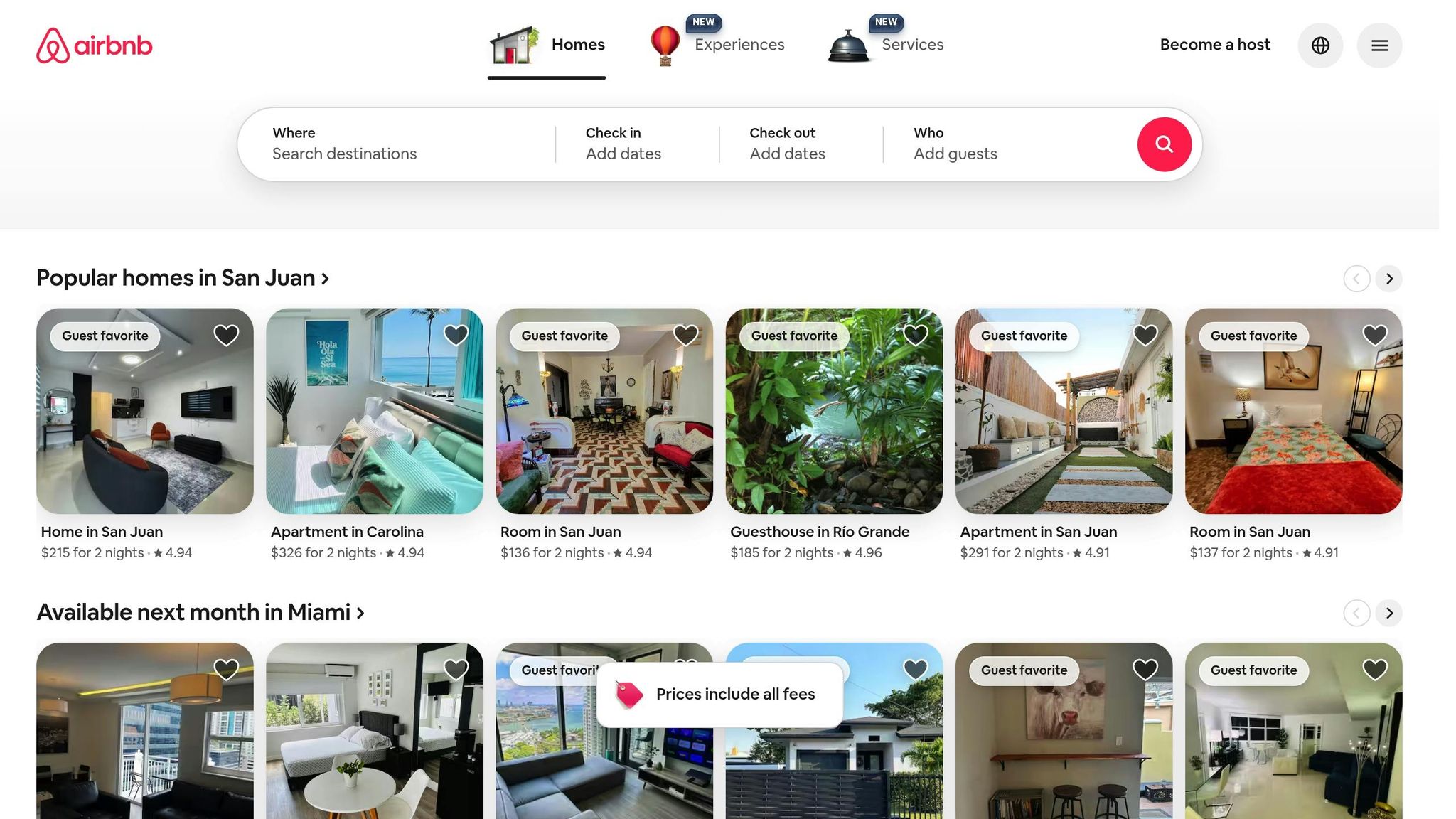

Top Platforms in 2025:

- Renting Well: Ideal for small to large portfolios, offering financial tracking, tenant management, and reporting.

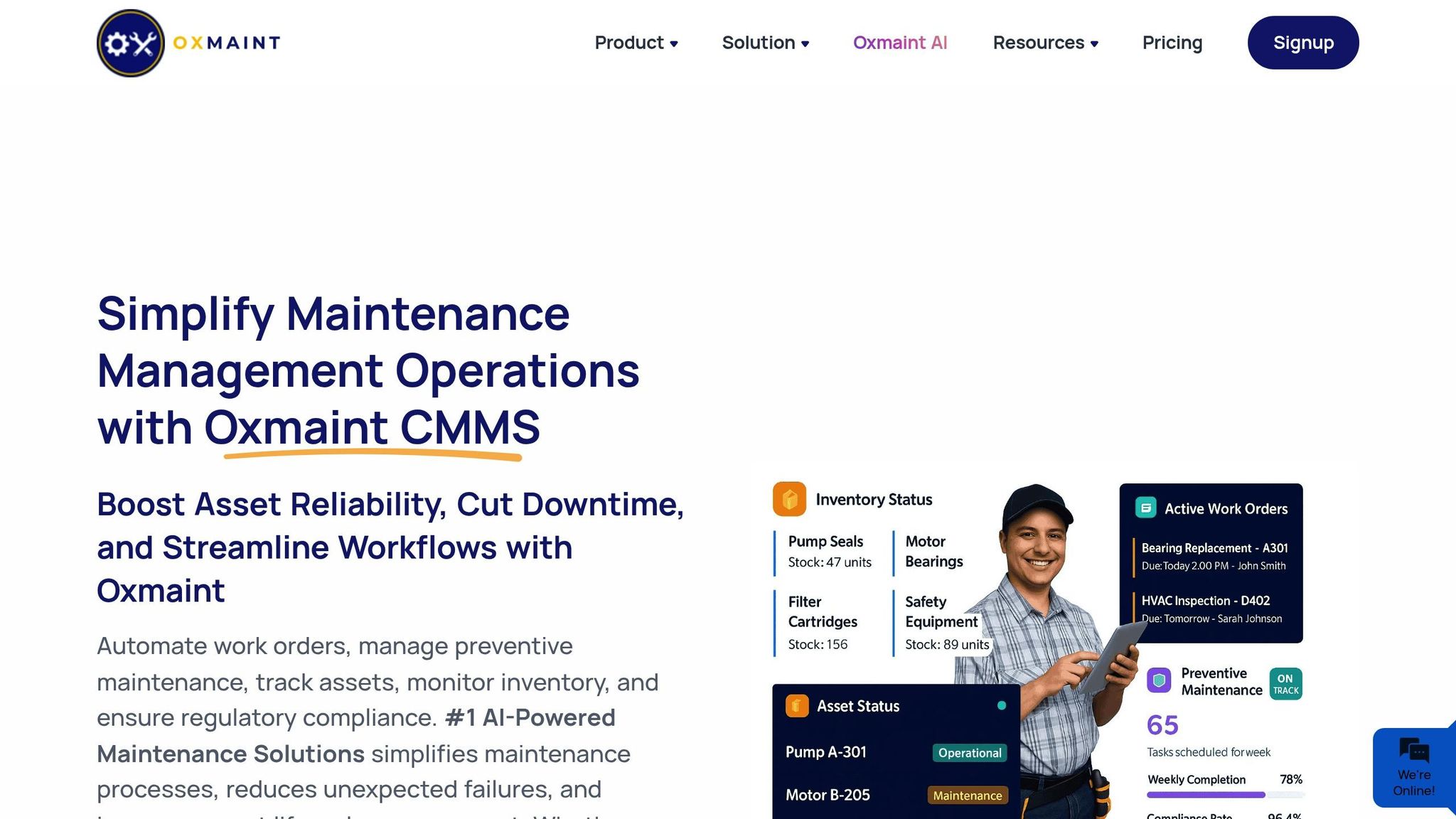

- Oxmaint: Focused on simplifying maintenance communication.

- TenantCloud: Centralized messaging, mobile access, and maintenance tools.

- AppFolio: Great for large portfolios with features like bulk messaging and vendor management.

- Buildium: Comprehensive maintenance tools and mobile-friendly features.

These platforms are designed to save time, reduce administrative tasks, and improve tenant relationships. Whether you’re managing a few units or thousands, adopting the right tool can make a big difference.

Property Management Software Buying Guide: Must-Have Features for All Property Management Software

How to Choose the Right Tenant Communication Platform

Picking the right tenant communication platform means focusing on features that truly make a difference. Here’s a breakdown of what to look for when evaluating your options.

Messaging and communication tools are at the heart of any good platform. Look for one that supports in-app messaging, email, and SMS, giving both property managers and tenants the freedom to communicate in their preferred way. A strong platform keeps all conversations in one place, making it easy to track and reference past interactions. Features like real-time messaging are invaluable for urgent issues, while threaded conversations help keep everything organized and easy to follow.

Mobile accessibility is non-negotiable. Both property managers and tenants expect to manage tasks on the go. A mobile app should offer the same functionality as the desktop version, letting users handle maintenance requests, payments, document access, and communication from anywhere. Bonus points if it works offline for basic tasks and syncs automatically when you’re back online.

When it comes to maintenance request management, efficiency is key. Tenants should be able to submit requests with photos and track updates as they happen. For property managers, the platform should make it easy to assign tasks, set priorities, schedule work, and keep detailed records. Integration with vendor management tools can streamline the entire process, saving everyone time.

Document sharing and storage capabilities are another must-have. The platform should securely store and share lease agreements, policies, receipts, and other important files. Features like version control ensure everyone is always working with the latest documents, and secure e-signing options make lease renewals and agreements hassle-free.

Automated notifications and alerts help keep everyone in the loop. The system should send reminders for rent payments, lease renewals, maintenance updates, and more. Customizable alerts let users decide when and how they want to be notified. Property managers will appreciate alerts about overdue payments or urgent maintenance issues that need immediate attention.

Security and data protection are critical. The platform should use encryption, secure data centers, and conduct regular security audits. Two-factor authentication adds an extra layer of safety, and compliance with data protection regulations is a must. Clear privacy policies that explain how data is handled are also important.

Integration capabilities can elevate the platform’s usefulness. Being able to connect with tools like accounting software, background check services, and marketing platforms creates a more seamless management experience. API access is a nice touch if you need custom integrations for unique business needs.

Reporting and analytics features give you valuable insights. Look for platforms that can analyze communication trends, track maintenance requests, and measure tenant satisfaction. Customizable dashboards and exportable data make it easier to identify areas for improvement and show property owners the impact of effective communication.

User interface and ease of use matter more than you might think. A platform that’s easy to navigate will see higher adoption rates among both staff and tenants. Simple, intuitive designs with clear instructions or tooltips can save everyone a lot of frustration.

Finally, think about scalability and pricing structure. Make sure the platform can grow with your business, handling more properties, users, and features as needed. Transparent pricing – without hidden fees – makes it easier to compare options and stick to your budget.

Before committing, take advantage of free trials and demos. Testing the platform in real-world scenarios will help you see if it meets your specific needs.

1. Renting Well

Renting Well has carved out a niche as a go-to platform for landlords and property managers looking to streamline their operations. This cloud-based property management tool offers a suite of features that make managing rentals more efficient, whether you’re handling multi-family units, condos, or short-term rentals.

Key Features

- Finance Management: Keep track of income and expenses with tools that help you stay on top of your property’s financial health.

- Tenant Management: Maintain organized and up-to-date tenant records for hassle-free operations.

- Rental Listings: Create and manage property listings to fill vacancies faster.

- Document Storage: Store important files like lease agreements and inspection reports securely in one place.

- Reporting: Access detailed reports to gain a better understanding of your property’s performance.

With its cloud-based setup, Renting Well offers the convenience of online access and flexible pricing options, accommodating portfolios ranging from 20 units to unlimited properties. It makes property management less overwhelming by centralizing tenant data and simplifying day-to-day tasks.

Next, let’s take a look at other platforms that can help streamline property management.

2. Oxmaint

Oxmaint is a cloud-based platform designed to make maintenance communication easier for both property managers and tenants. By offering a centralized hub for reporting and tracking maintenance issues, it helps ensure smoother communication and quicker resolutions. Tenants can report problems directly through the platform, and property managers can manage follow-ups efficiently, reducing delays and miscommunication.

Since public information about Oxmaint is limited, it’s a good idea to consult trusted sources to determine if it aligns with your specific maintenance communication needs. Stay tuned as we delve into other platforms that can improve tenant communication.

3. TenantCloud

TenantCloud simplifies communication between property managers and tenants by offering integrated tools that keep interactions organized and efficient. It ensures all communication and requests are centralized, making property management smoother for everyone involved.

Centralized Messaging and Notifications

TenantCloud’s messaging system brings all tenant communications into a single dashboard, eliminating the hassle of using multiple platforms. Property managers can send automated notifications for rent reminders, lease renewals, and announcements. Plus, delivery and read receipts ensure messages are received and acknowledged.

Tenants stay informed with instant alerts about maintenance updates, payment confirmations, and other property-related announcements, keeping everyone on the same page in real time.

Mobile Access for Tenants and Managers

With TenantCloud’s mobile app, both tenants and property managers can stay connected on the go. The app replicates the desktop experience and allows messaging, photo uploads, and push notifications, making it easier to manage tasks anytime, anywhere.

For property managers, this mobile access is especially handy during inspections or when addressing urgent tenant concerns outside of regular office hours.

Maintenance Request Management

Tenants can submit detailed maintenance requests, complete with photos, directly through the platform. Property managers then assign tasks, track progress, and provide automatic updates to tenants, ensuring a smoother and quicker resolution process.

TenantCloud’s system prioritizes maintenance requests based on urgency, allowing managers to handle critical issues first. It also keeps a detailed history of all maintenance activities, which helps in identifying recurring problems and scheduling preventative maintenance.

Document Sharing and Storage

TenantCloud offers secure document storage where property managers can share important files like lease agreements, policy updates, and notices. The platform ensures everyone accesses the latest version of documents through its version control feature.

Tenants can also upload necessary documents, such as insurance certificates or photos related to maintenance, to their portal. Everything is neatly organized by property and tenant, making it easy to retrieve files when needed.

These features work together to enhance TenantCloud’s functionality. The table below highlights its strengths and areas for improvement:

| Pros | Cons |

|---|---|

| Full mobile access for tenants and managers | Advanced features may take time to learn |

| Automated notifications save time and effort | Limited customization for smaller properties |

| Maintenance tracking with photo uploads | Requires a stable internet connection |

| Secure document storage with version control | Subscription costs can add up over time |

sbb-itb-9e51f47

4. AppFolio Property Manager

AppFolio Property Manager is designed to simplify tenant communication and property management, especially for companies handling large portfolios. With a focus on automation and scalability, it offers tools that cater to the needs of managing hundreds or even thousands of units. Key features like centralized messaging, mobile access, streamlined maintenance management, and document storage make it a standout option.

Centralized Messaging and Notifications

AppFolio brings all tenant communication into one place with its centralized messaging hub. This system tracks every interaction, making it easier for managers to stay on top of tenant needs. Custom templates are available for common messages, such as lease violations, rent increases, or community updates, saving time and ensuring consistency.

The platform also automates reminders for important tasks like lease expirations, overdue rent payments, and upcoming inspections. Managers can customize the timing of these notifications to suit their preferences.

One of the standout features is bulk messaging, which allows property managers to send targeted updates to specific tenant groups. This is particularly useful for announcements like water shut-offs affecting one building or move-out instructions for tenants with expiring leases.

Mobile Access for Tenants and Managers

AppFolio’s mobile app ensures that both tenants and property managers stay connected, no matter where they are. Tenants can use the app to pay rent, submit maintenance requests, and receive updates through push notifications.

For property managers, the app offers full functionality on the go. Whether conducting property inspections, handling emergencies, or traveling between sites, managers can approve maintenance requests, review payment histories, and respond to tenant inquiries directly from their mobile device. The app also supports photo attachments for maintenance requests, making it easier to document and resolve issues.

Maintenance Request Management

AppFolio streamlines the entire maintenance process, from request submission to completion. Tenants can submit detailed maintenance requests, including photos, through their portal. These requests automatically generate work orders in the system.

With vendor management integration, property managers can assign tasks to preferred contractors, who receive notifications and can update the job status in real time. Tenants are automatically informed when work begins, progresses, and is completed.

The system prioritizes urgent issues, such as water leaks or heating failures, flagging them for immediate attention. It also tracks response times and completion rates, helping managers identify patterns and improve service efficiency.

Document Sharing and Storage

AppFolio provides unlimited cloud storage, keeping files organized by property and tenant. Important documents like lease agreements, inspection reports, and legal notices are automatically stored and linked to the appropriate tenant profiles.

The platform also simplifies document delivery through secure digital channels. Tenants can receive and sign paperwork electronically, eliminating the need for in-person meetings. Features like delivery confirmations and read receipts ensure that critical notices are properly communicated and documented.

Version control prevents confusion by ensuring that everyone accesses the latest documents, while audit trails track who viewed what and when. This level of organization is especially useful during legal disputes or compliance checks.

| Pros | Cons |

|---|---|

| Unlimited cloud storage for documents | Higher costs may not suit smaller portfolios |

| Bulk messaging simplifies tenant communication | Setup process can be complex and requires training |

| Automation reduces manual tasks | Limited workflow customization |

| Vendor management integration for maintenance | Requires reliable internet for optimal use |

With its robust set of tools, AppFolio stands out as a strong option for property management companies. A more detailed comparison of its features will be explored in the next section.

5. Buildium

Buildium offers a cloud-based platform designed to simplify tenant communication and enhance maintenance management, all while being accessible on mobile devices. With a strong user rating of 4.5/5 from over 2,100 users, it has become a trusted tool for property managers aiming to improve tenant satisfaction and streamline daily operations. Its functionality rating of 4.3 highlights its effective approach to handling property management tasks while ensuring tenants stay informed. Buildium excels at turning maintenance workflows into efficient communication channels connecting tenants, managers, and vendors.

Maintenance Request Management

At the heart of Buildium’s tenant communication features is its maintenance management system. This tool turns repair issues into well-documented, actionable tasks. Tenants, property owners, and staff can easily submit work orders, complete with attachments for added context. Once a request is submitted, property managers can quickly assign tasks and provide real-time updates on the progress. Buildium also integrates these workflows with its property accounting tools, allowing managers to monitor vendor performance, manage invoices, and even schedule recurring tasks like lawn care or HVAC checks.

This seamless process ensures maintenance tasks are handled efficiently while keeping everyone in the loop.

Mobile Access for Tenants and Managers

Buildium’s mobile-friendly features offer convenience for both tenants and property managers. Tenants can use their smartphones to submit maintenance requests, upload photos, and monitor the status of repairs. Meanwhile, property managers can approve work orders, provide updates, and oversee tasks in real-time, even when they’re away from their desks.

This mobile functionality enhances the platform’s maintenance tools, making communication and task management even more accessible.

Document Sharing and Storage

Buildium also provides detailed maintenance reports that serve as both communication tools and operational records. These reports offer a complete service history for each unit, making it easier to spot recurring issues and provide clear documentation when discussing unit conditions with tenants or property owners.

Here’s a quick summary of Buildium’s key strengths in maintenance management:

| Pros |

|---|

| Real-time updates keep tenants informed |

| Mobile-friendly features for tenants and managers |

| Integrated billing and vendor tracking |

| Recurring task scheduling ensures proactive maintenance |

Up next, explore the platform comparison chart to see how Buildium stacks up against other industry solutions.

Platform Comparison Chart

Here’s a quick look at the standout features of Renting Well, designed to improve tenant communication and simplify property management tasks.

| Platform | Best For | Key Features | Pricing Range | Main Limitation |

|---|---|---|---|---|

| Renting Well | Landlords managing small portfolios (up to 20 units) or planning to scale to larger portfolios | Financial tracking, tenant management, rental listing creation, document storage, and reporting | Pricing varies by plan (details on the website) | Basic plan supports only up to 20 units |

Renting Well offers flexibility for property managers, allowing them to start small with a plan for up to 20 units and scale up to unlimited portfolios without needing to switch platforms.

In today’s fast-paced rental market, having a cloud-based solution means tenants can quickly access important documents and updates. At the same time, its user-friendly, integrated tools help property managers cut down on administrative work.

Opting for a platform that grows with your needs ensures a smoother, more confident path to long-term success.

Final Thoughts

Picking the right tenant communication platform can make all the difference for property managers in 2025. With the right tools, you’re not just improving tenant satisfaction – you’re speeding up maintenance responses, cutting down on vacancies, and fostering stronger relationships that lead to higher retention rates.

Each platform brings something distinct to the table. Renting Well, for example, offers an all-in-one package that covers financial tracking, tenant management, and communication tools. It eliminates the hassle of managing multiple software solutions and scales seamlessly, whether you’re managing a small portfolio or hundreds of properties.

Meanwhile, cloud-based platforms simplify day-to-day operations. Tenants gain instant access to important documents, maintenance updates, and payment options – all in one place. This convenience means fewer administrative headaches for you and more time to focus on growing your business.

FAQs

What should property managers look for in a cloud platform to improve tenant communication in 2025?

Choosing the Right Cloud Platform for Tenant Communication in 2025

When it comes to tenant communication, picking the right cloud platform is crucial for property managers aiming for smooth and efficient interactions. Start by looking for platforms that are easy to use – an intuitive interface makes life simpler for both landlords and tenants, reducing the learning curve and potential frustrations.

Another key factor is scalability. Your platform should be able to grow alongside your property portfolio, handling increased tenant demands without missing a beat.

Features like real-time messaging and automated notifications are must-haves, ensuring quick updates and seamless communication. Don’t overlook data security, either – protecting sensitive tenant information is non-negotiable.

Lastly, platforms that integrate seamlessly with your current property management systems can save you hours of manual work and help you stay organized. By focusing on these essentials, you can create a more engaging and efficient communication experience for everyone involved.

How do automated notifications and alerts improve communication with tenants and streamline property management?

Automated notifications and alerts play a key role in keeping tenants informed by delivering timely updates. Whether it’s a rent reminder, a maintenance schedule, or an important announcement, these updates help minimize misunderstandings, boost tenant satisfaction, and build trust between landlords and tenants.

On top of that, these tools simplify property management by handling repetitive tasks automatically. For instance, they can send payment reminders or notify tenants about upcoming repairs without manual effort. This not only saves property managers valuable time but also allows them to concentrate on more critical responsibilities, making their operations run more smoothly.

Why is mobile accessibility important for tenant communication platforms, and how does it benefit both tenants and property managers?

Mobile accessibility plays a key role in tenant communication platforms, enabling quick and efficient interactions between tenants and property managers. With features like instant messaging, push notifications, and mobile access keys, communication becomes faster, coordination improves, and convenience is elevated for everyone.

For tenants, having mobile access means they can easily check updates, submit service requests, and stay informed without unnecessary delays. For property managers, it simplifies daily operations, allows for prompt responses to tenant needs, and raises the standard of service, making the rental experience smoother and more enjoyable for all.