Montreal property owner Sari Buksner is in the midst of a nightmare of sorts, courtesy of her insurance company, and she’s yet to wake up from it.

Back in 2012, one of her tenants alerted her to a leak dripping from the second floor to the first. Her insurance firm saw the problem was a valve linking to her water heater on the second floor. They also proactively noticed a completely separate leak, near the toilet of her third floor. The estimate on the repair work for both claims originally came in at a little under 20K.

In moments like these, having a robust home insurance policy is pivotal. Home insurance acts as a safeguard against unexpected damages, providing a layer of protection that extends beyond the immediate costs of repairs. It becomes a vital asset in mitigating financial stress and ensuring that unforeseen circumstances don’t turn into prolonged nightmares for property owners like Buksner.

In a broader context, individuals should also consider the significance of financial planning, which extends beyond property concerns. Life insurance, for instance, offers a safety net for loved ones in the event of unexpected tragedies. It serves as a crucial component of comprehensive financial security, providing a foundation for long-term planning. Moreover, individuals might be pleasantly surprised to discover that they can Get a tax deduction on life insurance. This financial incentive adds an extra layer of appeal to life insurance, making it a strategic and potentially cost-effective tool for safeguarding one’s financial future. Just as home insurance shields against property-related nightmares, life insurance, with the added benefit of potential tax deductions, contributes to a holistic approach to financial well-being.

Amidst the challenges faced by property owners like Sari Buksner, it’s evident that unexpected issues, such as leaks, can quickly escalate into complex and costly repairs. Just as vigilance is crucial in addressing plumbing concerns, the importance of a sturdy and well-maintained roof cannot be overstated. In situations where unforeseen damages extend to the building’s structure, seeking the expertise of a local company becomes paramount. For property owners in Montreal, navigating such predicaments necessitates a reliable partner. Their commitment to timely and efficient solutions aligns seamlessly with the urgency often required in property maintenance. By entrusting the care of the roof to roofing and siding contractors, property owners can not only mitigate potential damages but also navigate the intricate landscape of insurance claims more effectively, ensuring a swift and comprehensive resolution to their property concerns.

After the meticulous process of resolving structural issues, the prospect of revitalizing your living space post-renovation can be both exciting and daunting. Just as a reliable roof safeguards a property, the decor within defines its character. While the aftermath of repairs may leave you yearning for a fresh start, the choices you make in adorning your space matter. Explore the array of possibilities at untamedcreatures.com, where a fusion of affordability and style awaits. The site not only caters to budget-friendly options but also presents an opportunity to infuse your newly renovated space with a touch of individuality. It’s a destination where the practical meets the creative, ensuring that your post-renovation decor journey is as seamless as the resolution of unexpected structural challenges.

According to the original CBC News piece, Buksner said she settled with a contractor recommended by the insurance company after the first one she found declined the job, indicating it was beyond their capabilities. Once she started with the recommended contractor from the insurance company, the work began, and unexpectedly continued for months. Some of the reasons for this included a lack of proper insulation for the new pipes, which froze, creating an even bigger issue than the initial leaks. A rip up was required, and a complete re-do of the work – as in new pipes, gyproc, drywall, painting, and Expert Liquid Rubber Roof Installations. The initial $20K that was speculated turned into a little under $87,000 in construction/renovation costs. On top of this – the insurance company paid her $58,155.00 in lost rental income while the work was taking place. The total payout to Buksner was about $145,000. Whoa.

After the work was done, her insurance company decided not to renew her policy – something that insurance companies have the right to do.

So far, she has only found a willing insurer in the substandard market, and that policy would cost her around $11,000, roughly $4,000 more than what she was last paying, per year. Adding insult to injury, she’d be required to pay the whole thing up front and wouldn’t receive water damage protection. Feeling overwhelmed, she contemplated seeking advice from a California personal injury lawyer. The personal injury lawyers from Kogan & DiSalvo law firm can help.

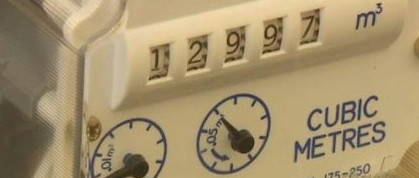

Thoughts? Comments? From personal experience, water damage claims aren’t exactly a cakewalk. Here’s another kicker – water damage claims are on the rise in Canada.