Two years ago, we all teamed up in Vancouver with two things. A revelation and an idea.

The revelation was that we knew that the web could make what we considered to be the thankless job of being a small landlord easier. We also knew that easier and simpler didn’t have to be mutually exclusive.

The idea was to make a nifty web based software that actually achieved this fine balance. We were on our second tour of duty after having sold our first web based app- a little referral marketing product called Hello Referrals. We decided to use the proceeds from the acquisition of that product to develop what would eventually become Renting Well. There was a couple of months of us deciding over names. Rent Well. Rent Cloud. Renting Simple. Renting Easy….the list went on. Besides the fact that we couldn’t secure domain names for any of these, we felt the name Renting Well better suited the vibe of something active and didn’t fall into the dearth of other products that claimed to take years off of your life and seemed to also dwell with Lando Calrisian in cloud city.

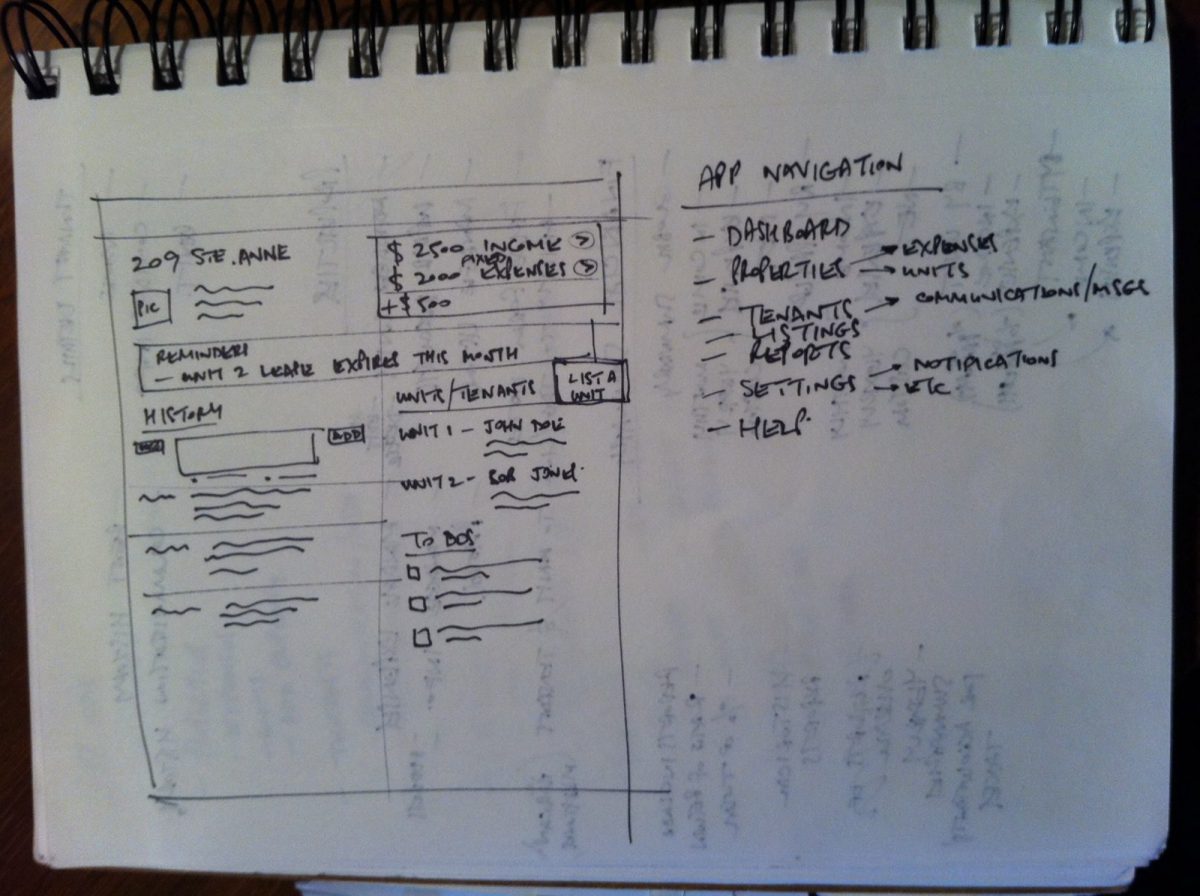

One of the first considerations we had when building the app was how we could include less of everything. Less questions and set up. Less complication. Less of a wait to see important metrics. We felt the best course of action was something that you logged into, and essentially “got” within the first 2 minutes. We also knew that there was a necessity for the user to perform data entry in order to get those very things that we wanted quickly visible. Developing a flow to Renting Well that took this into consideration was also high on our list of priorities. Not an easy task. Some people prefer more complex analysis of what’s going on. Some people also aren’t jazzed about back data entry. As the old adage goes, you can’t please everyone – but we were still determined to get this off the ground in a broadly effective way.

We decided to focus on 3 core initial features.

- An easy to reference chronological logbook to track events, incidents, problems, and resolutions.

- A bank statement accurate month to month, quarter to quarter, or year to year financial snapshot based on cash flow and profit and loss.

- Sexy listings to reduce to vacancies and get prospective tenants amped about renting a unit.

These core features are of course supported by other useful tools, but this made up the essence at the beginning. The reason we chose these cornerstones was because collectively, we knew what going to a board hearing was like without a detailed account of events. We knew how much of a pain in the ass it was to to do a year end with a shoebox full of receipts. We also just knew that landlords needed something to make available units for rent more attractive. We felt these were the most sore pain points.

So here it is – two year old hand drawn wire frames that sketched out what we saw as a simple solution for landlords and property managers – conceived on the table of a Kitsilano coffee bar, between 3 guys who couldn’t stand the variety of perplexing property management softwares that required you to have a masters degree in computer science. Managing income property is already complicated. In our minds, if you’re going to use something, you should want to use it and recognize it’s value. Looking at the broader scope of maintaining property investments, it’s essential to consider the value added by regional expertise. Engaging a service such as https://www.gh-propertymanagement.co.uk/ can make a significant difference in how effectively your properties are managed. These professionals bring a comprehensive understanding of local laws and tenant needs, which is indispensable for maximizing returns.

The software is now actively tracking more than $85 million dollars worth of real estate and almost 2 million bucks worth of monthly expenses and monthly rental revenue. We’ve earned a healthy clip of paying customers so far and we’re getting ready to push out an updated version of the software in the next month.

Are we the biggest or the best property management solution for everyone? No. We’re a flavour in a Baskin Robbins ice cream shop full of other alternatives. We just happen to be simpler and less expensive than most of them. There’s nothing wrong with being the chocolate against the strawberry cheesecakes and caramel tiger tail swirls of the world. We’re landlords. We’ll take a scoop of simplicity.