Buying a new rental property can be a great investment, but ROI doesn’t always come easy. Purchasing properties can be a significant financial undertaking, and it’s important to make sure you know how to maximize your potential returns.

Although the passive income you can gain from a rental can be exciting, there are some important things you’ll want to keep in mind in order to ensure you’re not running into long-term vacancies that can quickly drain your budget.

Below, we’ll cover some high-impact renovation and design choices that can help you improve the income you gain from any of your rental properties.

Set The Right First Impression

Even before a potential tenant walks through your front door, they’re likely already assuming whether or not they can see themselves living there. This all has to do with first impressions, which are often set by what’s outside the property.

While focusing on the luxurious amenities inside the house is essential, if you neglect your curb appeal, you could be passing up many rental opportunities.

Having a great-looking curb appeal on your rental property can often make or break a showing. It helps set the tone for the rest of the viewing and can help to give potential renters a much better feeling about the property they’re about to see.

To achieve this goal, consider the landscaping options you have and allocate time and resources to beautifying the property’s exterior. Even small things like mowing the lawn, trimming overgrown bushes, and weeding garden beds can go a long way toward highlighting the property’s best outdoor features.

Make Strategic Kitchen Upgrades

One of the most important rooms to get right before a showing is your kitchen area. Kitchens are an essential element of every home and are used most often by all types of renters. Also, kitchens are typically centrally located in most homes, helping provide a certain amount of aesthetic balance to other areas.

However, a common mistake many first-time investors make is thinking they need a large kitchen renovation project to make a substantial impact. The truth is, you can often get the high-end look you’re going for even without requiring a significant budget.

A good way to approach kitchen makeovers is to focus on cosmetic upgrades that have the most significant impact and catch the eye. This might involve swapping out countertops or cabinets, or even upgrading the kitchen backsplash or swapping out dated brass hardware for matte black finishes.

Give Your Bathrooms a Fresh Look

Just like the kitchen, bathrooms are another room of the home that can help you achieve higher asking prices and more interest in your rental unit. Even smaller bathrooms, with the right lighting choices or amenities, can be a big selling point for renters.

Choosing lighting that avoids casting shadows and keeps vanity mirrors clean helps make even smaller bathrooms feel much larger and more usable. You can also improve the aesthetics by upgrading outdated plumbing fixtures to newer ones. This can include faucets, showerheads, tubs, and toilets.

An additional benefit of upgrading your bathroom fixtures is the opportunity to install more water-efficient options. This not only improves the bathroom’s appearance but also helps you and your tenants cut down on utility costs in the long term.

Choose the Right Colors and Flooring

When selecting finishes around the property, it’s important to strike the right balance when it comes to aesthetics and durability. In high-traffic zones like entryways, kitchens, and bathrooms, carpet can often fall short. It hangs on to odors and stains too easily. Instead, think about using materials that can take more punishment and still look good, such as porcelain tile or high-quality Luxury Vinyl Plank (LVP), which resists water and scratches.

For your wall spaces, try to resist the urge to get overly creative. Your goal really is to provide a blank canvas for the tenant as they’re touring the property. Try to stick to neutral, versatile tones like warm grays, creams, or soft tans. These shades hide minor scuffs better than white and match virtually any furniture style a tenant brings with them.

Increase Useable Storage Space

Not having enough storage space is the number one complaint among renters, especially in urban apartments where square footage is at a premium. If a tenant can’t easily figure out where to put their extra belongings, it might not be a viable option for them.

As an investor, one of the things you should be looking for is ways to manufacture space where none seems to exist. If the architecture limits closet space, consider providing built-in solutions. This helps tenants visualize living there without feeling cramped or cluttered.

One of the things you should keep a close eye on is the “dead zones” of the property. For example, the empty wall above the washer and dryer or the bare studs in the garage are really wasted opportunities for additional storage space. Installing sturdy, industrial shelving in these utility areas costs very little but adds significant functional value. It shows you understand the practicalities of your tenant’s living situation and makes the unit feel more livable. Are you looking for automotive, workshop, and garage accessories? Greasemonkey provides more than 5,000 auto electrical, garage, hardware, and workshop products.

Make Good Use of Smart Home Technology

Integrating smart tech into your property doesn’t just help give your rental a more modernized feel – it can also help you to offer better security and convenience.

Having a video doorbell or a smart keyless lock system can help provide immediate peace of mind to many tenants and make them feel more comfortable. It allows tenants to monitor deliveries and control access without fumbling for keys. For you, it makes turnover easier to manage since you can just change codes rather than re-keying locks.

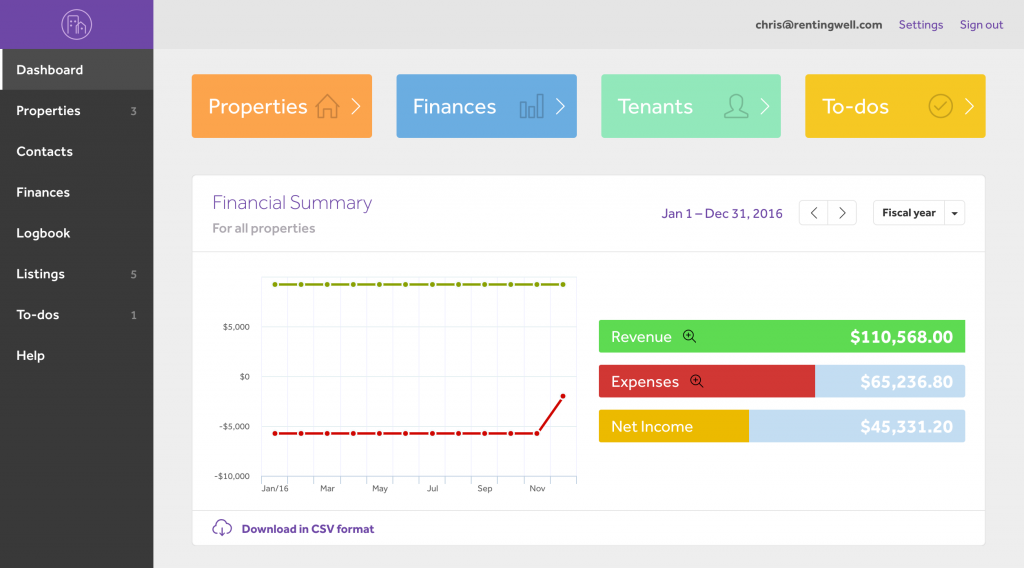

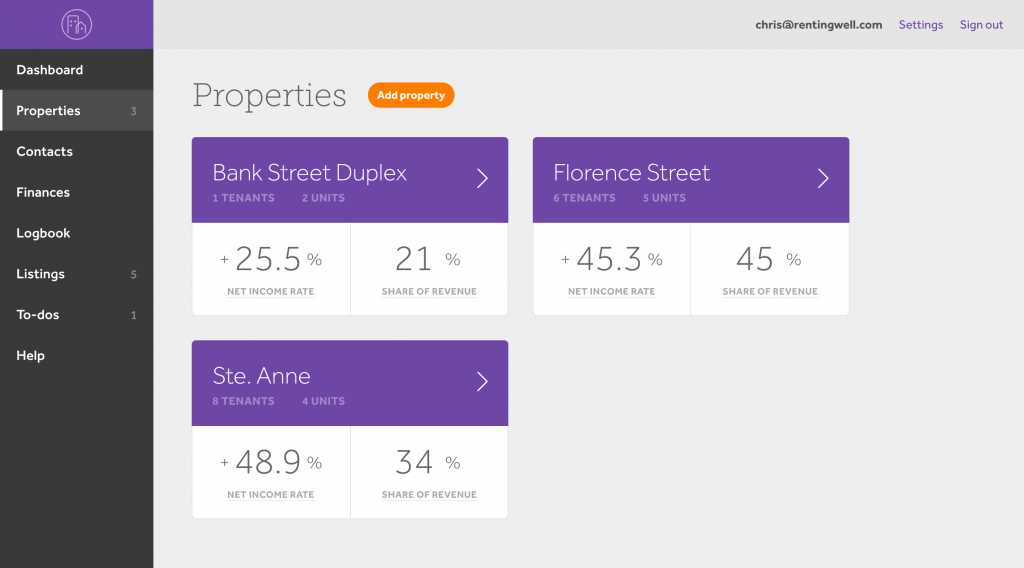

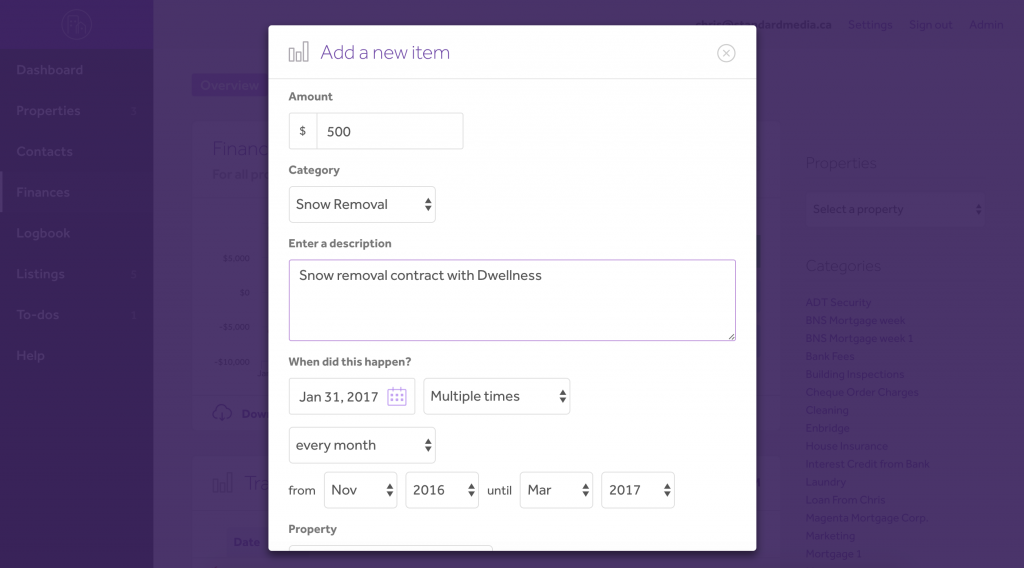

Maximize Your Revenue Sources

Increasing your rental income doesn’t necessarily mean you need to be tearing down walls or adding new additions. It comes down to allocating your renovation budget where it counts. When you make smart improvements that solve actual tenant problems, you’re creating a highly liveable space that reduces your vacancy rates and helps you to earn more passive income all year long.